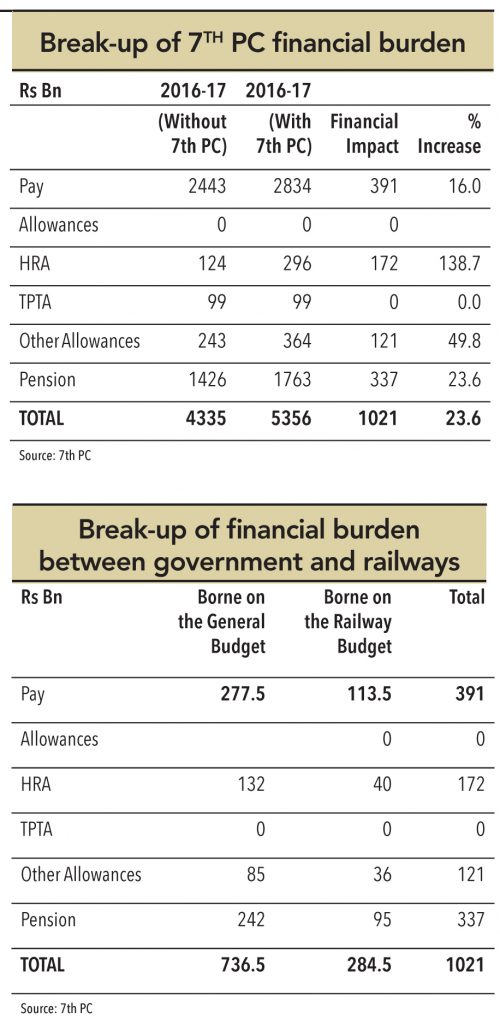

The 7th PC was set up in February 2014 and submitted its final report to the finance ministry in November 2015. The finance ministry is in the process of reviewing the recommendations and final implementation will depend on what it accepts and rejects. The word on the street is that the government may not accept all recommendations – therefore, out of the total estimated financial dent of Rs 1tn for the 7th PC, the government is expected to save about Rs 300bn.

“The key expectation of employees at all levels is that there should be a significant increase in their pay and improvement in other facilities. Representatives of some of the recognised organisations have staked their claims for grant of a pay structure comparable to that of the private sector.”

-7th PC

“The real challenge before this commission is to provide a pay structure that is competitive yet affordable, attractive yet acceptable, forward-looking yet adaptable, simple yet rational, and one that matches the current socio-economic and political conditions as well as the changing perception of the overall administrative machinery and the public governance system”

– 7th PC

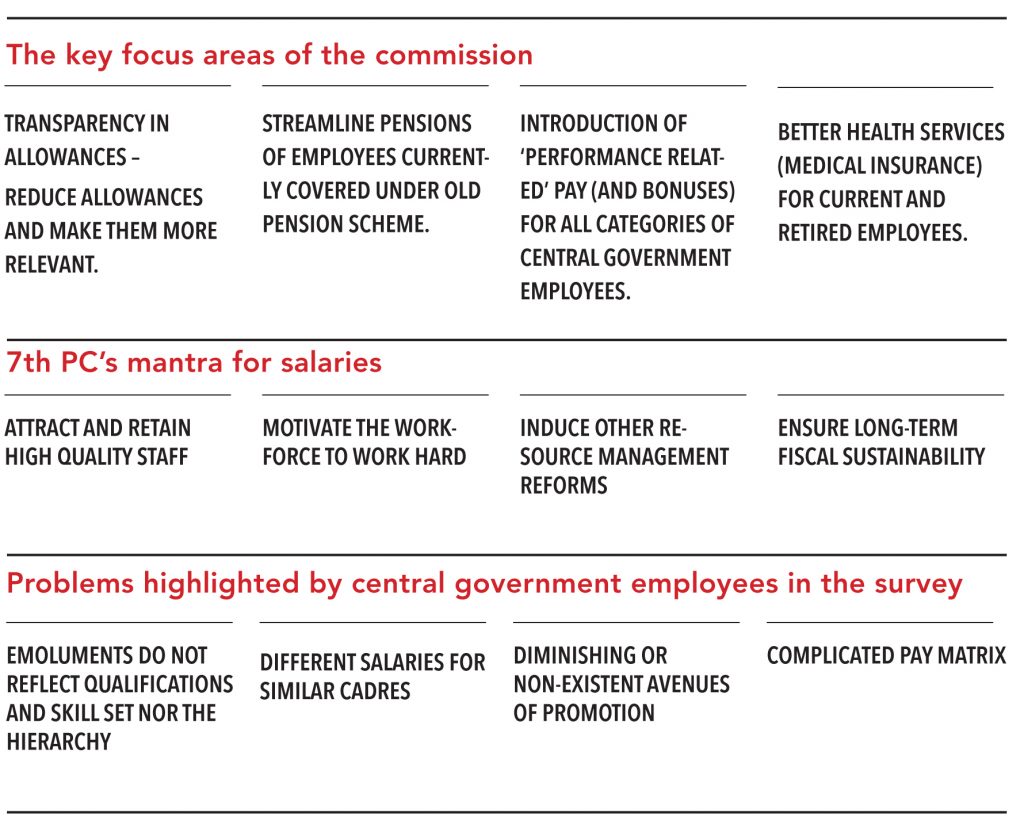

The commission has tried to address these problems and recommended/ proposed:

• The entire pay structure should be reviewed, rationalised, and simplified

• Inter-departmental and inter-ministerial disparities regarding payment of various allowances should be removed as far as possible

• An innovative ‘risk and hardship’ matrix should be introduced

• Uniformity in qualification and pay structure: At each level, the minimum pay should be equal to the entry pay for direct recruits into those levels. Currently entry pay takes into consideration qualifying standards – salaries of those promoted from lower levels is set at minimum pay of the band plus grade pay corresponding to the new grade; therefore entry pay varies for someone entering a level directly and someone getting promoted. The new pay matrix proposes that direct recruits start at the minimum pay corresponding to the level at which the recruitment is made.

• Each level should be placed equidistantly – implying that various stages within a level move up at the rate of 3% per annum – similar to the rate of annual increment within a level (recommended at 3%)

• Salaries should be raised more (than currently practiced) in case of promotions

• Uniformity in fixing pay (whether entry-level, on promotion, or while migrating from one pay regime to another)

• New pay structure should bring out clearly what the total emoluments will be at a given point in time during the employee’s career span

• The rate of pay progression should be stated upfront for existing and new entrants

• Strong need to encourage, reward,and promote performance

• All non-performers should be phased out in 20-years – a strong recommendation

• Performance-related pay should be introduced and all bonus payments should be linked to productivity

“The organisation systems in the government are generally large, multi-layered, and complex.”

– 7th PC

7th PC new pay model

The 7th PC has suggested a new pay model after receiving feedback from various employees. Here are the details:

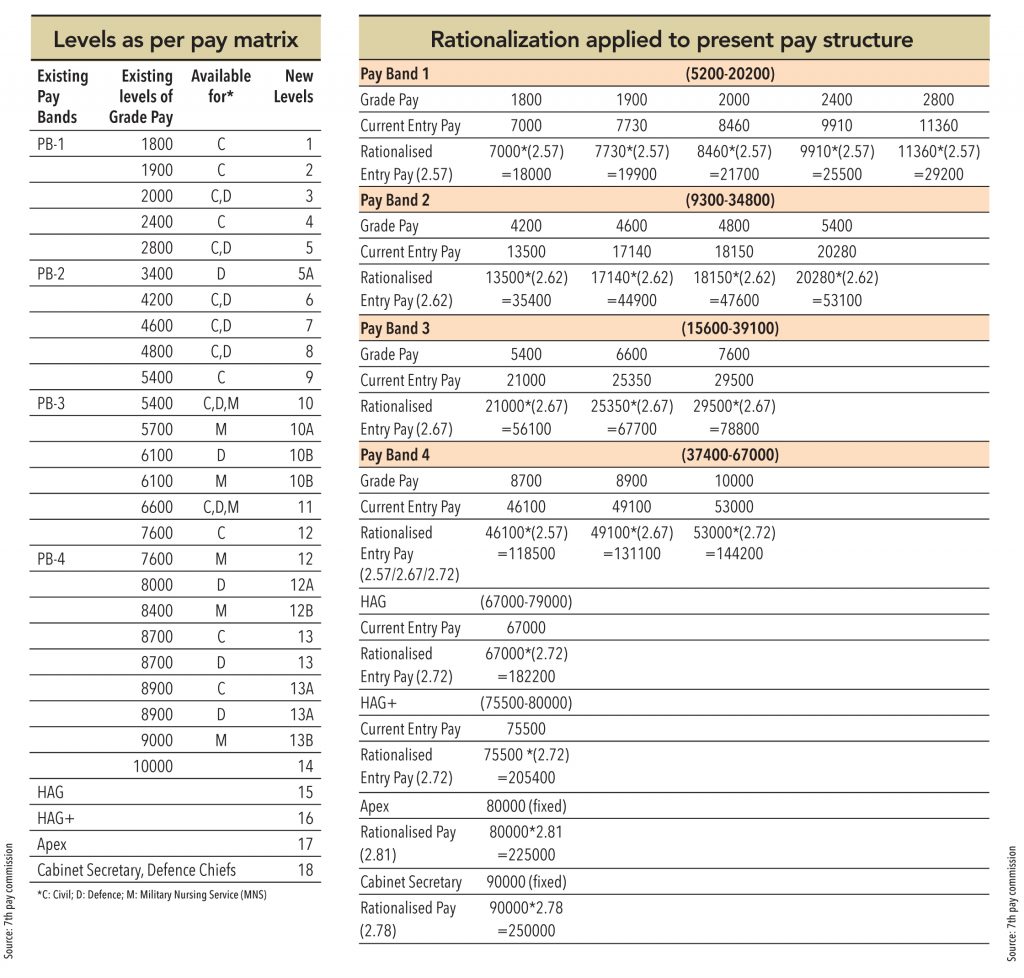

• System of pay bands and grade pay should be removed. Has proposed new functional levels.

• New pay structure is in the form of a pay matrix to provide complete transparency about pay progression.

• Minimum pay at Rs 18,000 per month.

• Fitment factor of 2.57 – multiply current salaries by 2.57 to arrive at new pay scale.

• Annual increment at 3%.

• Highest pay fixed at Rs 250,000 per month.

• Compression ratio is at 1:3.12 implying that entry-level salaries of Group A employees is 3.12x higher than those of entry-level Group C employees.

• Compression ratio is at 1:3.96 for maximum salary.

• New salaries will be effective from 1st January 2016 vs. the demand of 1st January 2014.

• Employees unable to meet performance criteria within the first 20 years of their service should not receive future annual increments or should be asked to leave service (voluntary retirement).

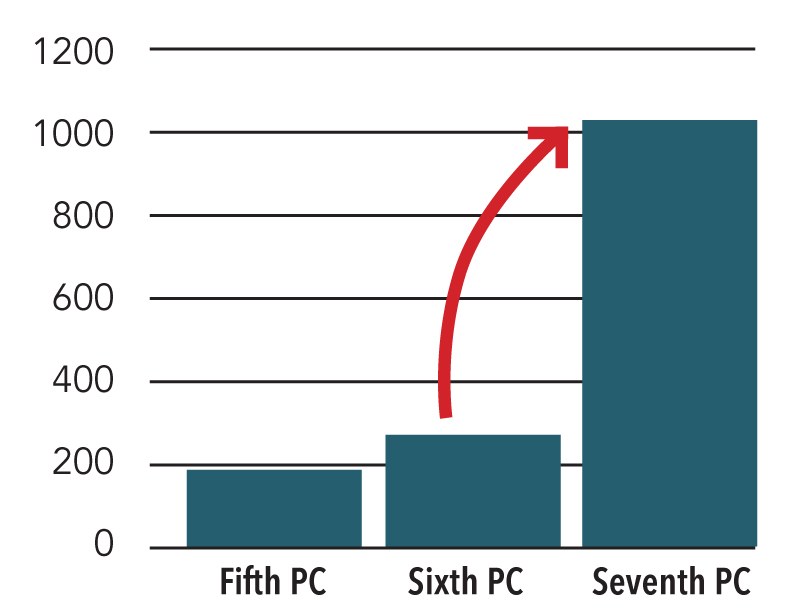

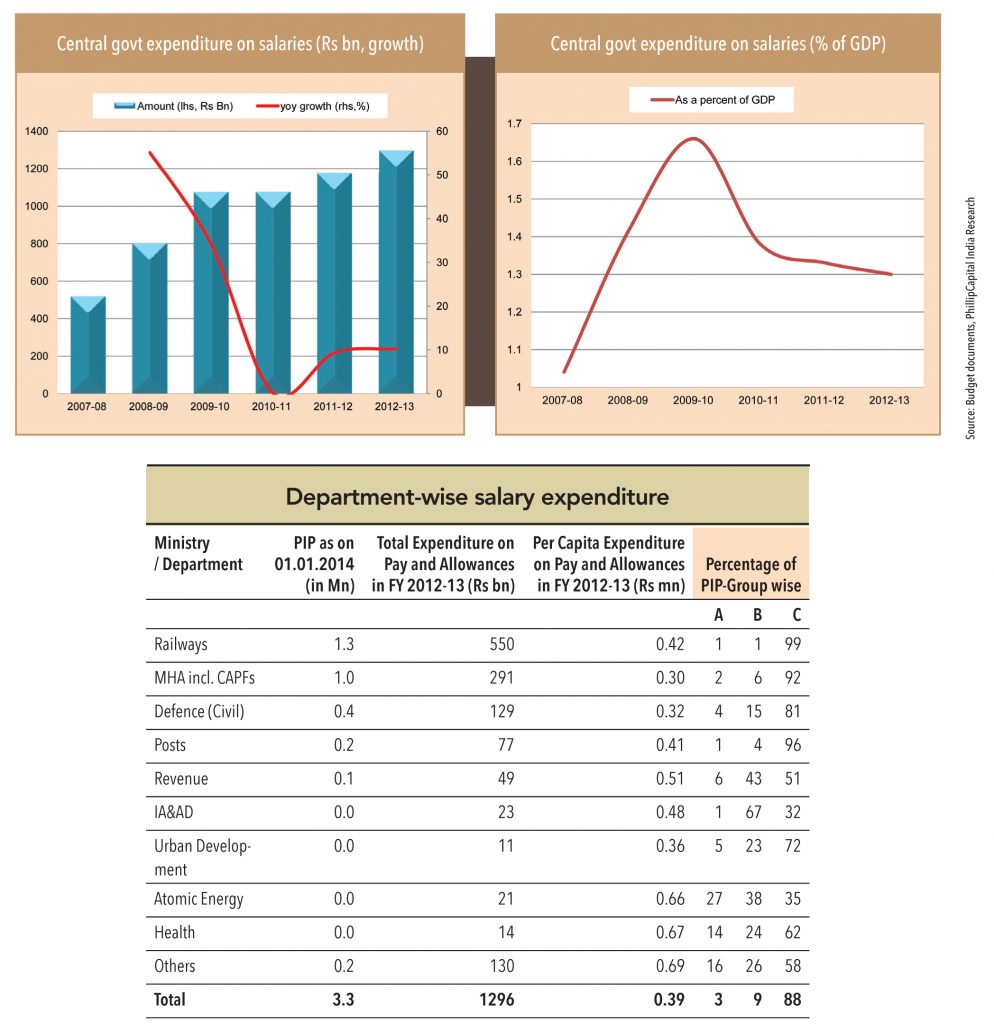

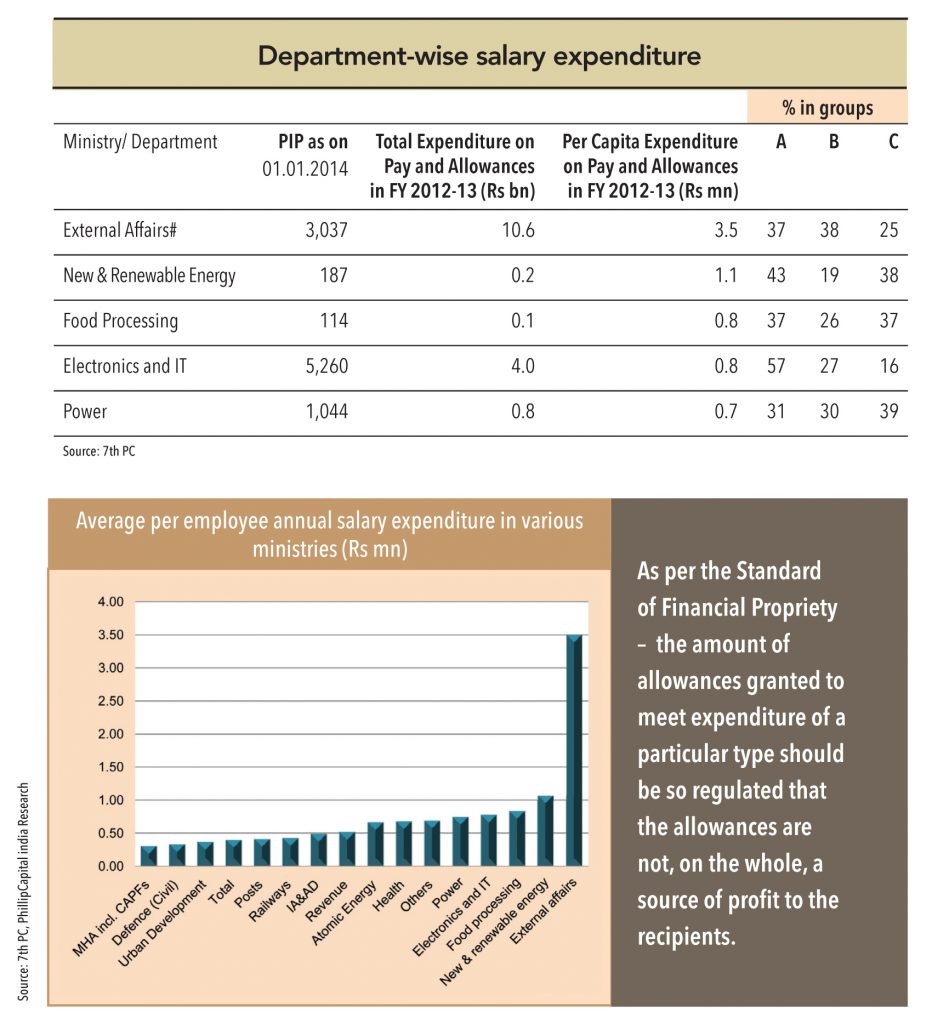

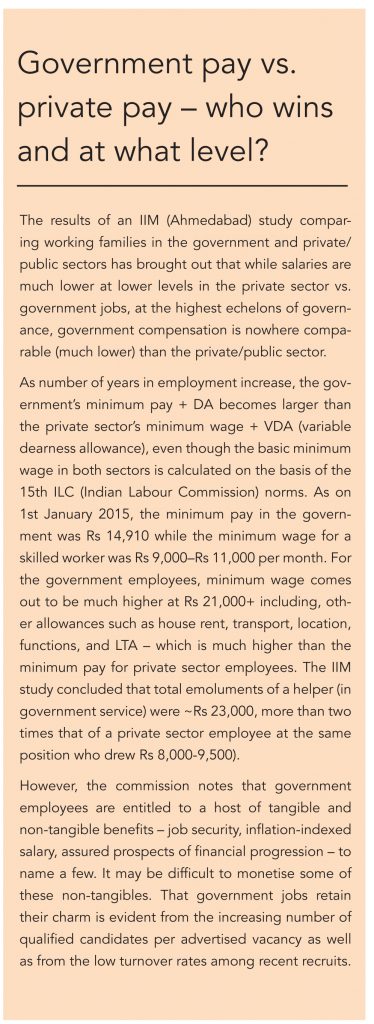

In FY13, total expenditure on salaries was Rs 1.3tn (1.3% of GDP); payout has doubled in the last six-years. At the time of implementation of sixth pay commission (in FY09-10), salary expenditure increased by 90%. Annual increases in the following years were at 10%. The ministry of railways spends the highest on salaries, followed by home affairs, defence, posts, revenue, and urban development. Average per-person expenditure was Rs 400,000 per annum.

Per capita expenditure was higher for ministries that had greater A group employees (external affairs, renewable energy, food processing, electronic & IT, and power).

Pay commissions can give only as much as the government can support. The pay commission recommendations are reasonable – I will be more than happy if the recommendations are implemented as it is

– A respondent to GV’s survey on 7th PC

“Would have been happy if existing privileges and allowances had continued”

– GV survey respondent

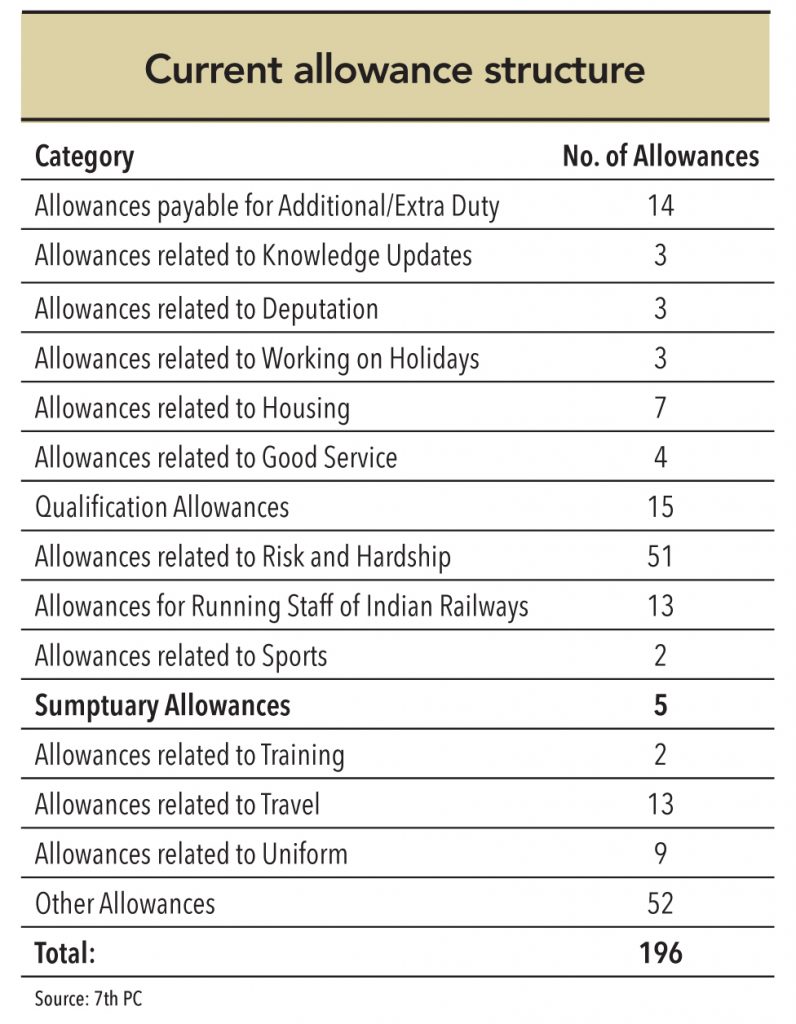

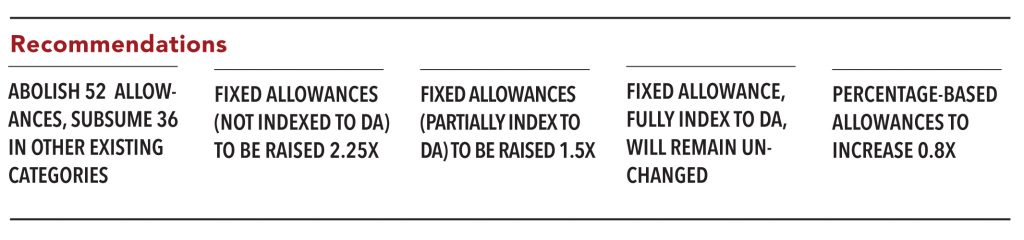

An allowance is the sum of money paid to the employee for a specific purpose. For the government employees, allowance is an addition to their basic pay (paid as a proportion on basic pay or as a fixed amount). 7th PC’s observations include:

• Allowances are quite large and need to be streamlined, as is the case internationally

• Need for continuation and coverage has been looked at

• Rationalisation continued

As per the Standard of Financial Propriety – the amount of allowances granted to meet expenditure of a particular type should be so regulated that the allowances are not, on the whole, a source of profit to the recipients.

Respondents are unhappy about discontinuation of few allowances

– Takeaway from GV’s survey

“Pension scheme, consistent with available resources, must provide that a pensioner would be able to live free from want, with decency, independence and self-respect, and at a standard equivalent to pre-retirement levels” – Supreme Court judgement

Currently, 50% of last pay drawn is treated as pension for central government employees.

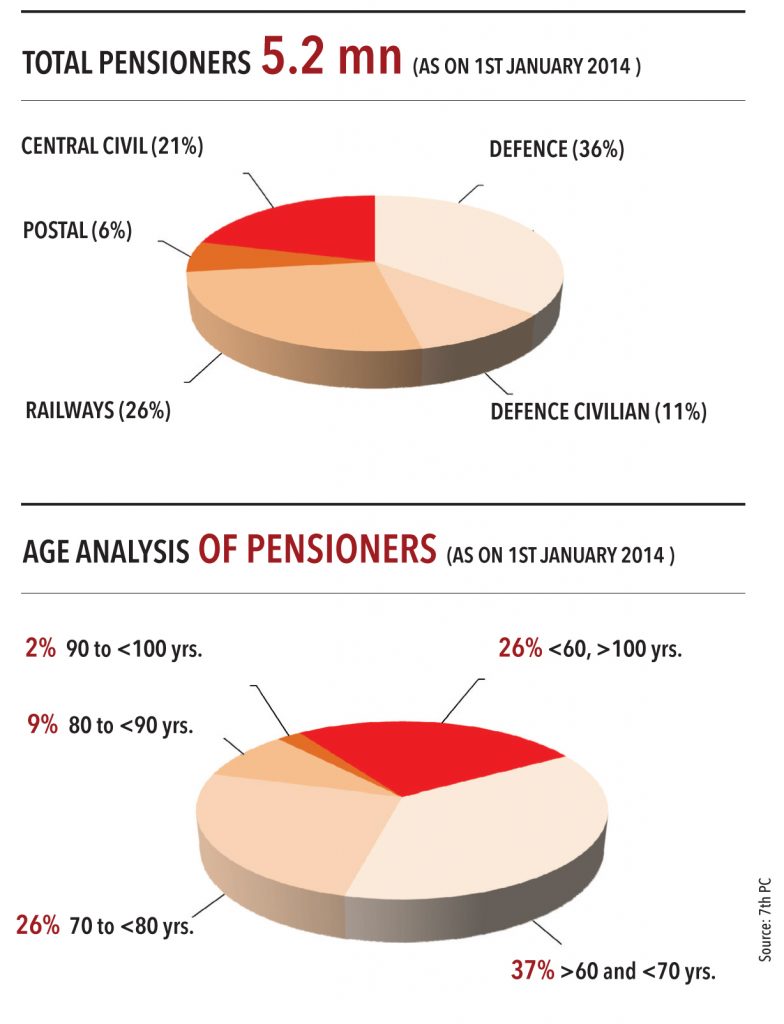

Strength of pensioners

Pensioners are classified into civil and defence – within civilians, large sectors are central civil, railways, and postal.

Expenditure on pension

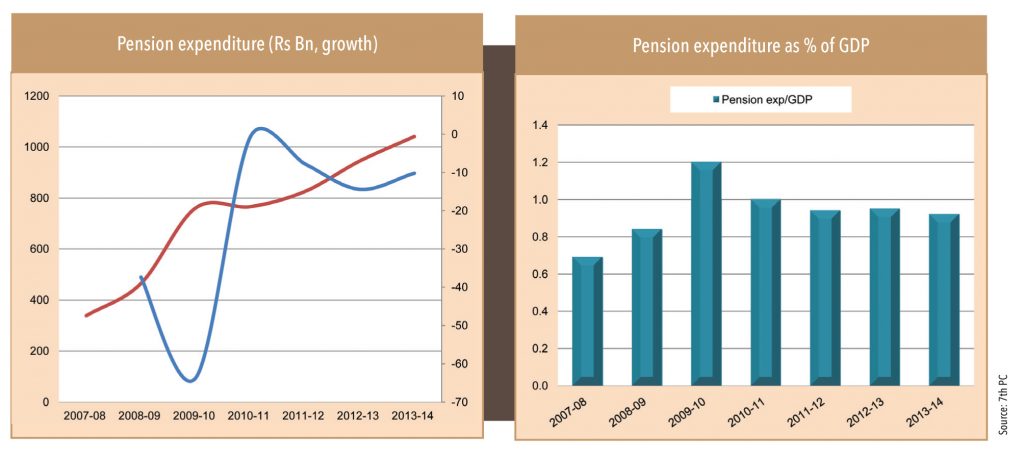

Total pension expenditure as on 1st January 2014 stood at Rs 1tn (0.9% of GDP). In FY09-10, after the 6th PC, pensions rose by a cumulative 100% (increase from 0.7% of GDP in FY08 to 1.2% in FY10) – similar to salaries. After that, average increase has been to the tune of 7.8% in FY12 and 14% in FY13.

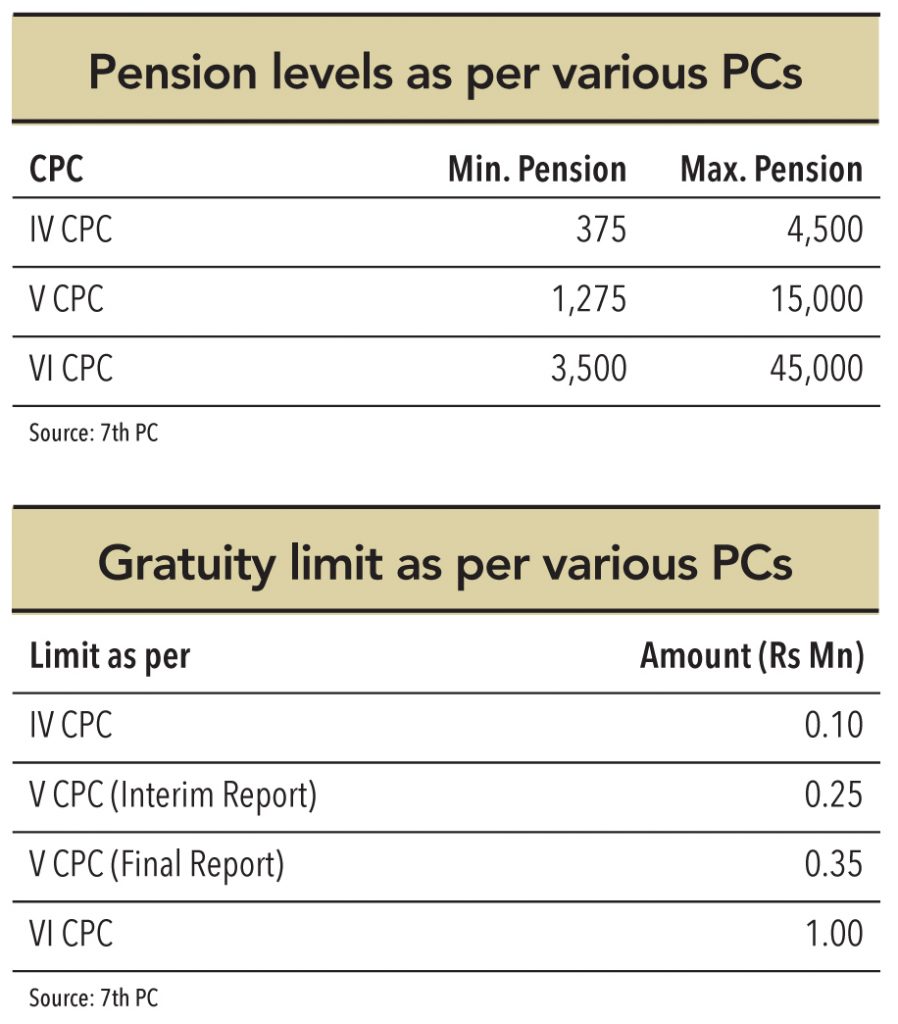

7th PC recommends:

• Minimum pension should be increased to Rs 9000 from Rs 3500 – in line with minimum recommended salary.

• Gratuity limit should be enhanced to Rs 2mn from current Rs 1mn.

“Same pay (specially at the entry level) must be given to similar minimum qualification, like is the case for all doctors; however, for graduates and post graduates, it varies from department to department”

– A central government employee responding to GV’s survey

An analysis of the 7th PC reveals that:

1. A lion’s share of central government employees (88%) are either industrial or operational workforce.Therefore, the contention that the central government’s wage bill is for administrative purposes is ill conceived. Thus, government’s workforce is doing a qualitative job, in accordance with the needs of the government machinery. As a large number of personnel employed by the government are through contracts, a major segment of government function has been pushed into informal sectors – not a clear positive.

2. Expenditure on pay and allowances as a percentage of revenue expenditure has been falling over the years, implying that rise in salaries has not been out of proportion.

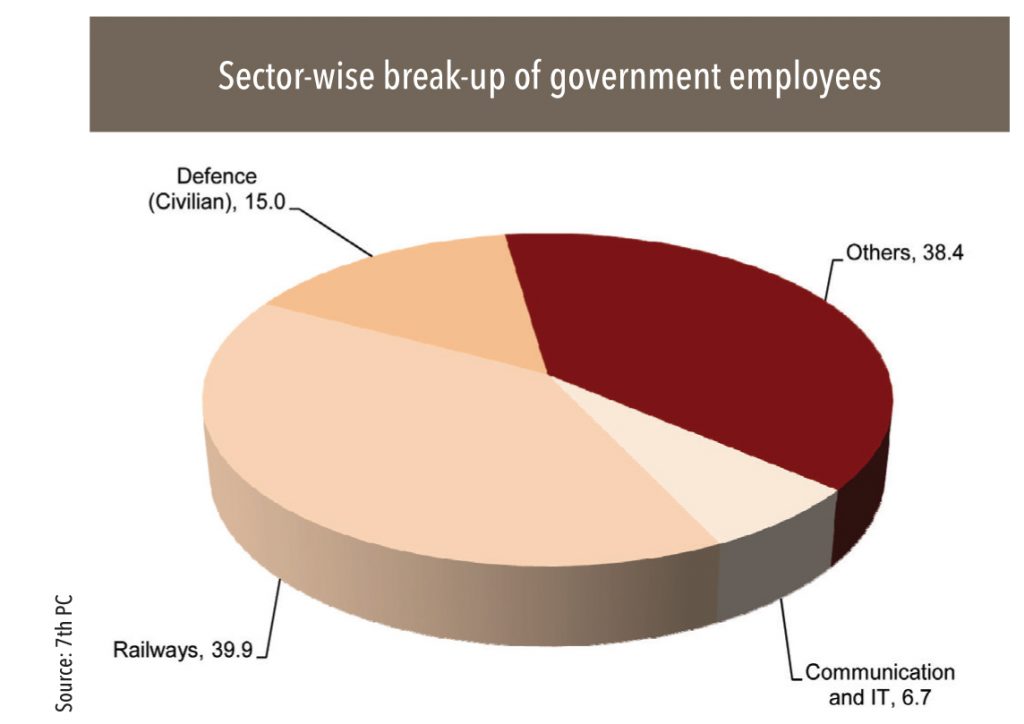

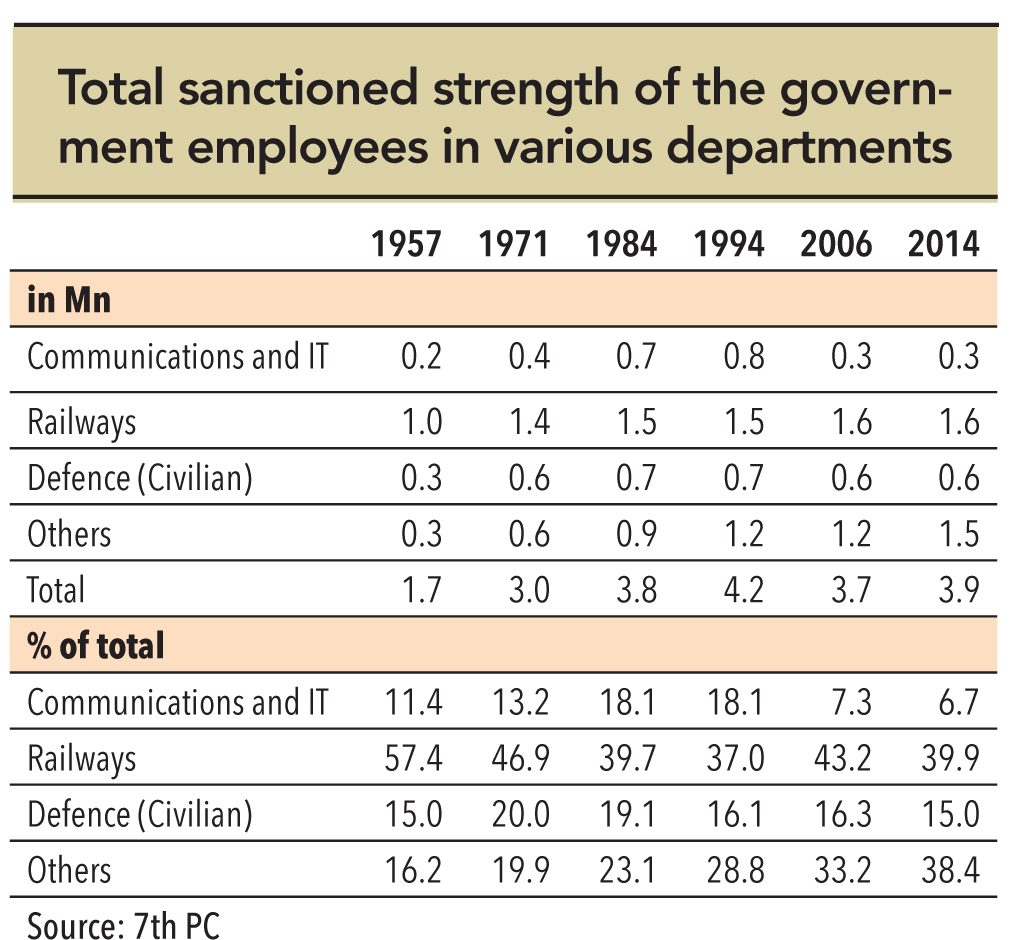

Total central government employees in 2014 were 4mn – of which 40% were with railways, 38% others (largely home ministry [police]), about 15% were with defence, and 7% with communication and IT. Government employment in telecommunications has fallen substantially since 1994 due to corporatisation of the sector. While absolute employment in railways was stable, it was declining for defence and rising for police.

Annual Direct Recruitment Plan (ADRP) was set up by the fifth pay commission, which resulted in a consistent fall in the strength of government employees. As a guideline, new hiring was set at 1% of the staff strength and retiring employees at 3%. As a result, net employee strength reduced by 2% every year since 2001-2009. ADRP was discontinued after the recommendations of the 6th PC as it led to important positions remaining vacant and to an ageing bureaucracy that was reluctant to change and adopt technology.Now these decisions are made by individual ministries and departments.

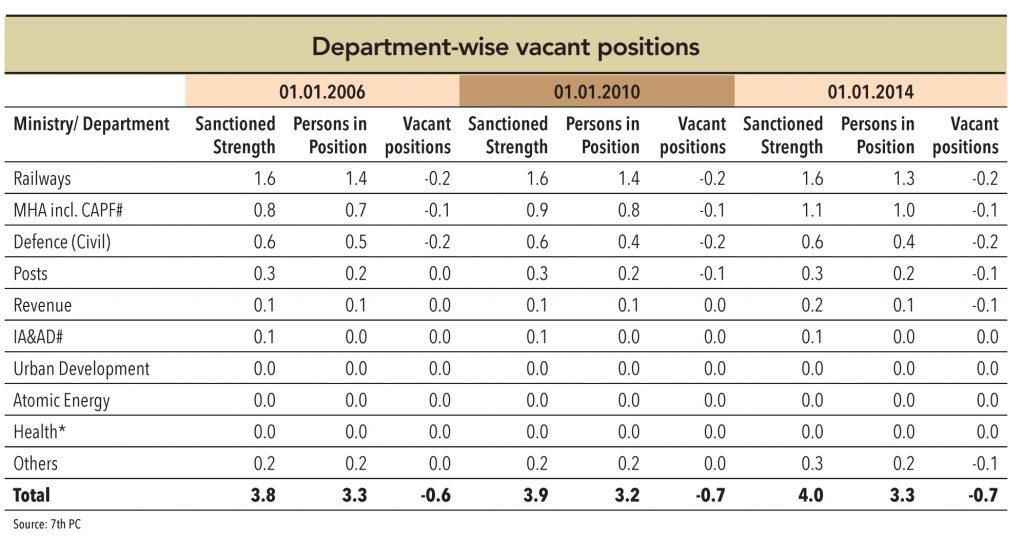

After ADRP was dismantled, hiring shot up with maximum hiring (81% of total) by the ministry of railways and in the police force. Average annual hiring by the central government between 2006-2014 was 100,000. The seventh pay commission is of the view that the central government is an insignificant source of employment generation. However, the fact is there are substantial (most in the last 10 years) vacant positions in these ministries – about 700,000 people need to be hired (200,000 each in defence and railways and 100,000 each in home ministry, postal, and revenue).

Global comparison

There are 14 central government employees for every million people in India; USA has 67. In India, government employees are saturated in few departments such as police, defence, and railways, which is also the case in the USA where its department of defence, homeland security, and veteran affairs employs 94% of government employees.

“One should get proper and adequate compensation for merit. The increase in pay structure cannot keep pace with the market forces (private sector). At the same time, it should not be so unattractive that talent is not attracted to government service.”

– 7th PC

“The remuneration package is such that employees would feel that they are valued, are fairly paid, and their remuneration is not less than a person who is similarly situated in another organisation. While addressing this aspirational need, we are also conscious of the fact that such employees who have outlived their utility, their services need not be continued, and the continuance of such persons in the system should be discouraged.”

– 7th PC

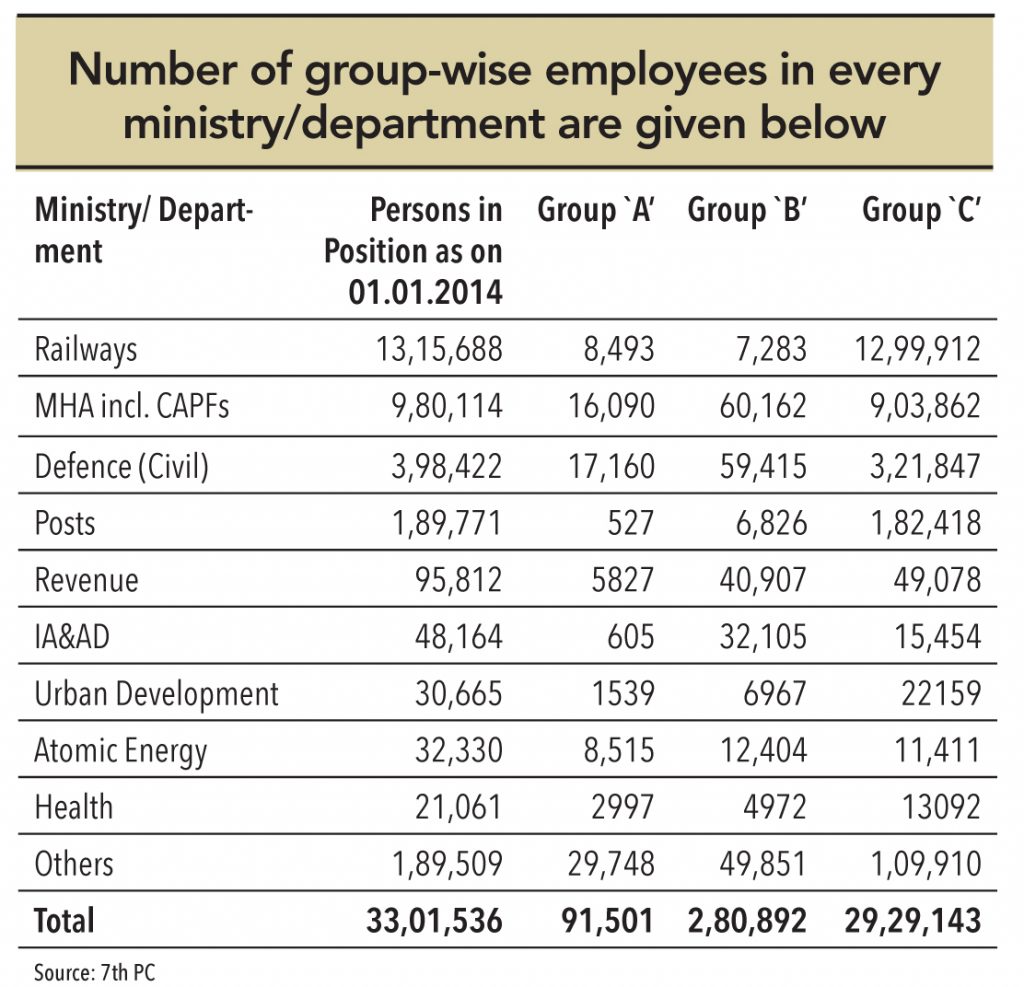

Grades are based on pay band. For central government employees, groups are categorised as A, B, and C. Maximum employment is in the C grade.

• 89% of the government employees are in group C, 8% in group B, and 3% in group A.

• C-group employees constitute the highest group – 99% of total employees in railways, 96% in postal, and 92% in home affairs.

• Scientific and technical-focused departments (space, electronics, IT, renewable energy, civil aviation, and external affairs) have higher proportion (57-37%) of employees in group A.

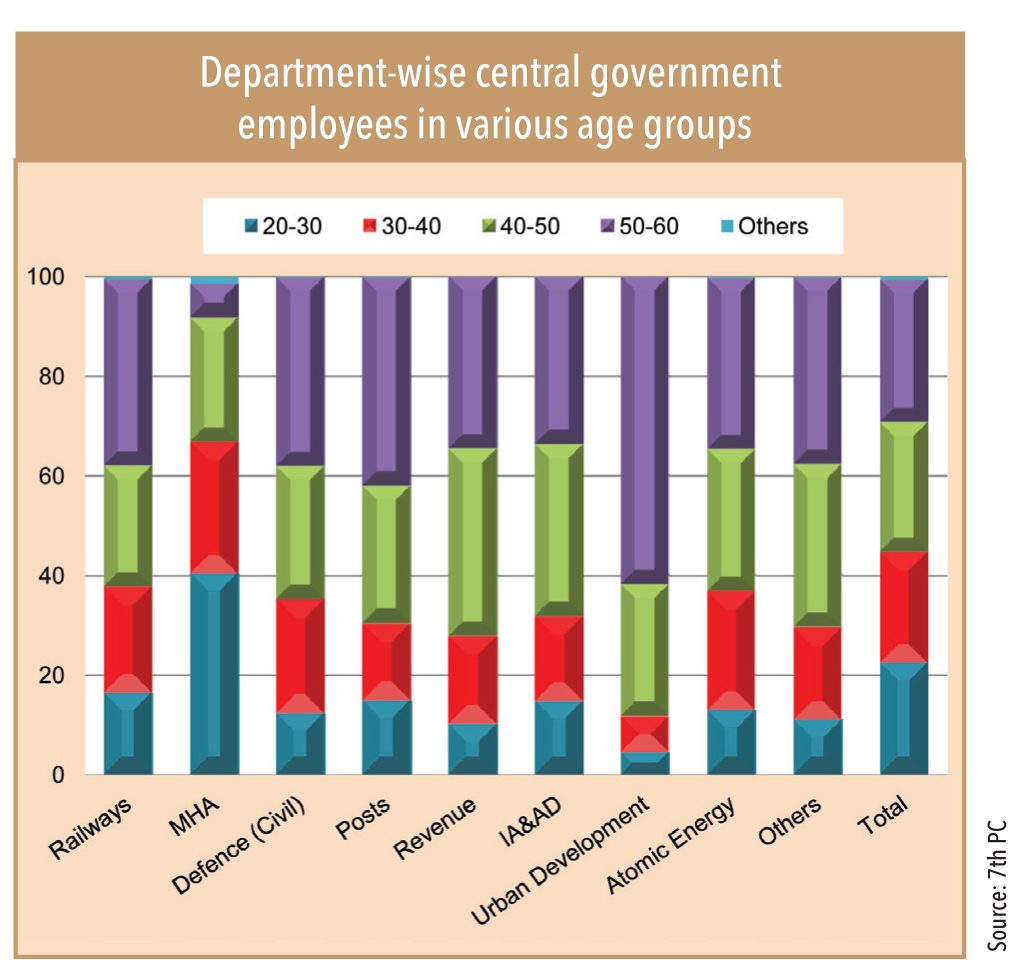

As of 1st January 2014, the largest chunk (29%) of central government employees (29%) were in the age group 50-59 followed by (26%) in 40-49, while 22% (each) were in the bracket 30-39 and 20-29.

Some key conclusions:

• Ministries that have many employees in the 50-60 year age bracket and at high risk for loss of experienced employees – these include textiles 75%, coal 64%, urban development 62%, petroleum & natural gas 60%, science & technology 57%, heavy industry 56%, new & renewable energy 52%, AYUSH 51%, and power 50%. 7th PC finds that these ministries will lose experienced employees in the next 10 years and advises departments to prepare/train younger employees to meet current and future requirements.

• The youngest population of employees is thriving in the ministry of home affairs with 40% in the age group 20-30, followed by 16% in railways, and 15% in postal.

• The proportion of younger employees in smaller ministries (drinking water, panchayati raj, parliamentary affairs,rural development) is much lower vs. larger ones.

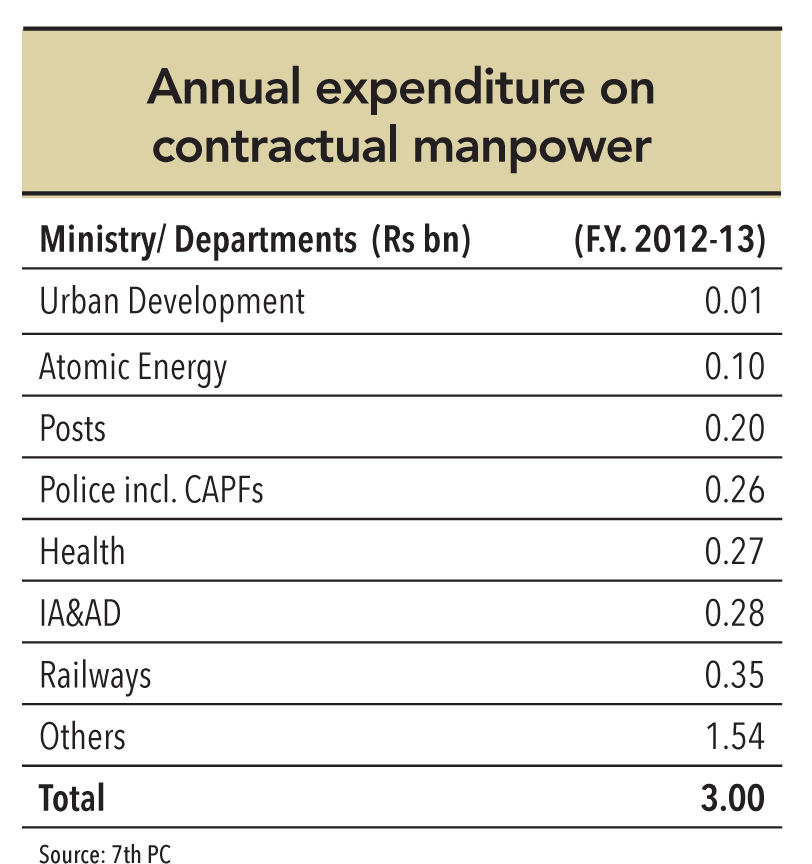

Total expenditure on contractual employees by the government was Rs 3bn in FY13. Contractual employees comprise of:

• Housekeeping, maintenance, related activities,data entry, driving etc.

• Contractual employment for certain technical posts with high professional skills.

• Retirees from the government – hired due to their expertise, experience, and knowledge.

The seventh pay commission (with the inputs from various ministries) has recommended that contractual employment should be continued, but with appropriate guidelines about the kind of jobs that can be outsourced. At the same time, critical posts requiring confidentiality should not be outsourced. The current spending on contractual employment is insignificant, but likely to rise gradually. In the light of more retiring personnel from various ministries, the pay commission suggests that more retired employees should be hired due to their experience and expertise.

5th PC

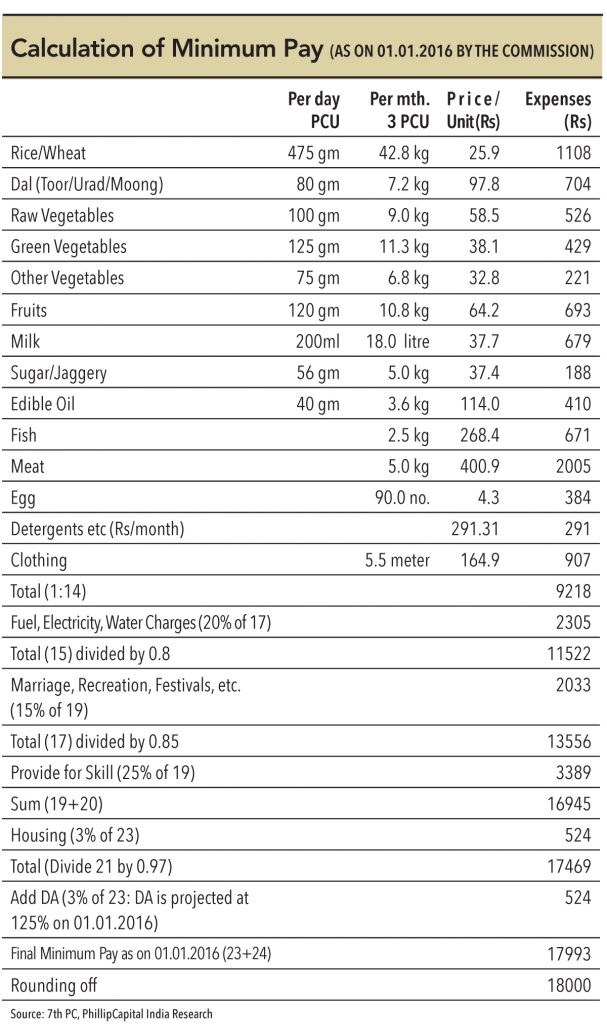

Adopted a constant relative income approach based on growth in real minimum income, in line with real per capita income of the country, reflecting the inflation and economic growth trends. Minimum wage was set at Rs 2,440 on 1st January 1996.

6th PC

Adopted need-based wage, implying wages should cover all the needs (food, clothes, house/rent, fuel/electricity, additional expenses like education, medical treatment, recreation, festivals and ceremonies) of a worker’s family. Minimum was fixed at Rs 7,000 per month as on 1st January 2006.

7th PC

Adopted need-based wage (same as 6th) and arrived at a minimum wage of Rs 18,000 per month as on 1st January 2016. This is almost 2.57 times of the minimum wage recommended by the sixth pay commission,implying that all scales will have to be multiplied by this to arrive at seventh pay commission levels – 2.25 times for merging of basic pay with DA (assumed at 125%) and 0.32 times reflecting the real increase of 14.2% (2.57/2.25 = 1.1429).

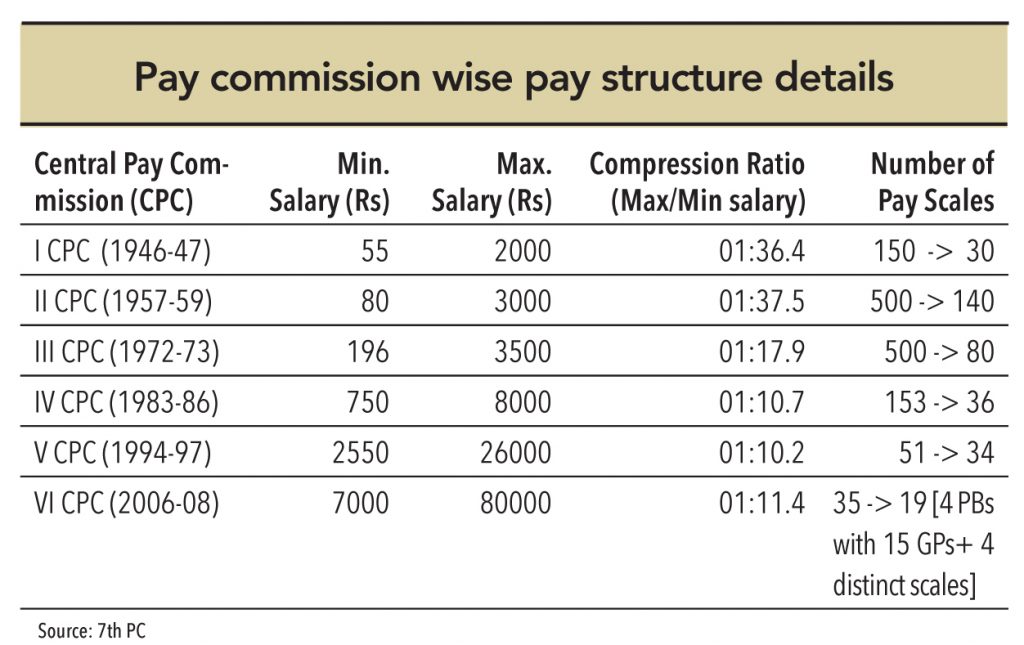

Pay commissions have consistently attempted to reduce the number of employment scales in the government’s hierarchy. The sixth pay commission saw a marginal increase in the compression ratio (which is the maximum salary drawn by the secretary to the government vs. minimum salary drawn by the lowest functionary in the government).

REDUCTION IN NUMBER OF PAY SCALES

REDUCTION IN COMPRESSION RATIO

ANNUAL INCREMENT IN PERCENTAGE TERMS RATHER THAN A FIXED AMOUNT

ELIMINATION OF GROUP D AND SHIFTING OF EMPLOYEES TO GROUP C AFTER APPROPRIATE TRAINING

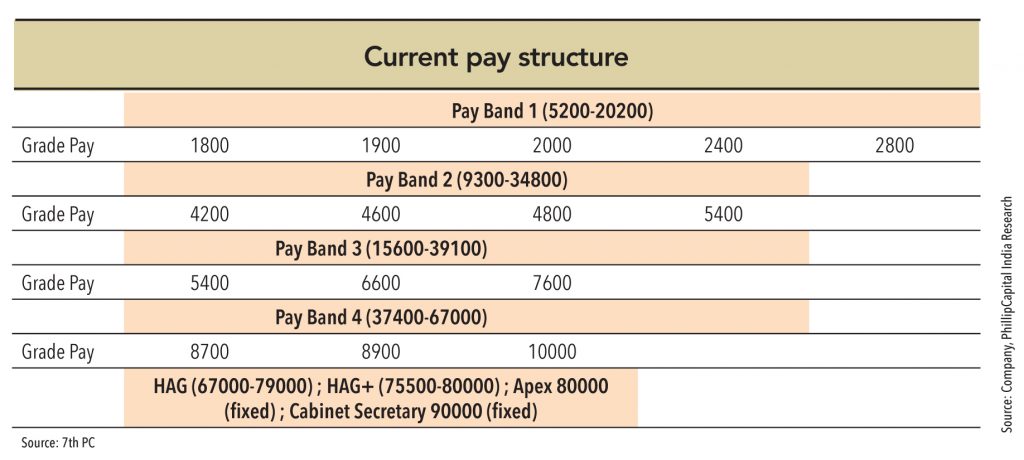

Current pay bands (based on 6th PC) comprises of 19 grades (reduced from 35 in the 5th) – four pay bands (with 15 levels of grade pay) along with four higher scales of HAG, HAG+, apex, and cabinet-secretary rank.

“Cuts in a few perks like LTA are unwelcome”

– GV survey respondent

Subscribe to enjoy uninterrupted access