In developed markets such as the US, ‘omni-channel’ was a response to the threat posed by low-cost online retailers. Retailers such as Macy’s, John Lewis , and Burberry successfully implemented an omni-channel strategy.

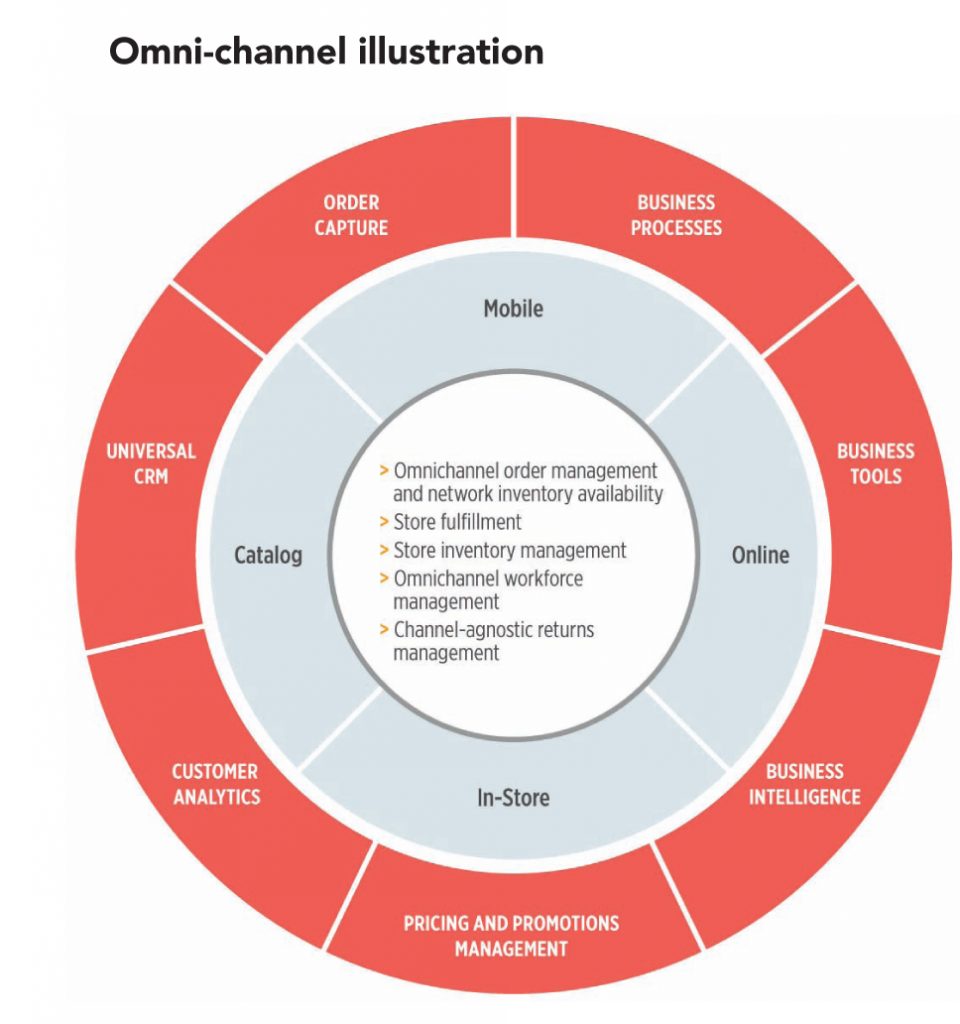

“Omni channel is a multi-channel touch point. It combines brick and mortar with virtual channelsbe it the website or mobile,” says Sanjay Chakravarti, CFO, Shoppers Stop. Both formats, i.e., brick and mortar and virtual, are seamlessly synchronised in omni-channel retailing. If the customer doesn’t get a particular product in the store, he or she can browse for it on a kiosk or on the website/app and complete the order.

“Customers are becoming increasingly agnostic to the channels they are buying from. It’s going to be an integrated market, but the reality is that we haven’t reached there yet in India,” says an industry expert. The industry participants that we interacted with, including leading ecommerce practitioners (each involved in some major initiative) concur that going forward, omni is the future. When asked whether they were already behind the curve, most of them said that it’s just the beginning. Mr Rakesh Biyani, Jt MD Future Retail, says, “We are going online because the customer wants this. Businesses have to fundamentally adapt to technology. We initiated the process over a year ago, when the buzz in Indian online was nowhere near what it is today.” He goes on to say that, “consumers’ perception of technology and service has undergone a change and it is only evolving. Consumers today want to shop from anyplace and anywhere, and interestingly, are willing to wait for the product. Online players haven’t triggered any decision making for us. The reason we adopted omni-channel is because we had already migrated our operations to run a centralised warehouse/distribution centre, assortment approach, and back end — it just happened to coincide with the noise around ecommerce. We felt the need to invest in technology to move to the next leg.”

“Omni channel makes sense for any brand which has a large retail presence”, says Mr Vijay Basrur of Raymond. The 89-year old brand has been one of the few Indian brands to have launched its own ecommerce venture Raymondnext.com. The Aditya Birla group has launched trendin.com which retails its brands including some of India’s largest brands such as Louis Philippe. But no one is anywhere close to creating a great shopping experience, says Mr Bawankule of Google.

Nevertheless, Omni Channel has multiple benefits when executed well. Even in the developed markets (US and UK) 85-90% retail is still offline. The reality is that most of the retail is anchored around physical assets of manufacturing, product strategy, stores, and distribution set up. Omni-channel brings real assets to compliment online stores so that they don’t eat into each other’s sales but rather, complement each other — sales strategies under omni-channel include click-and-pick, reserve the product, and shipping from the store instead of the distribution centre.

A solution to one of the biggest challenges for retailers – Inventory

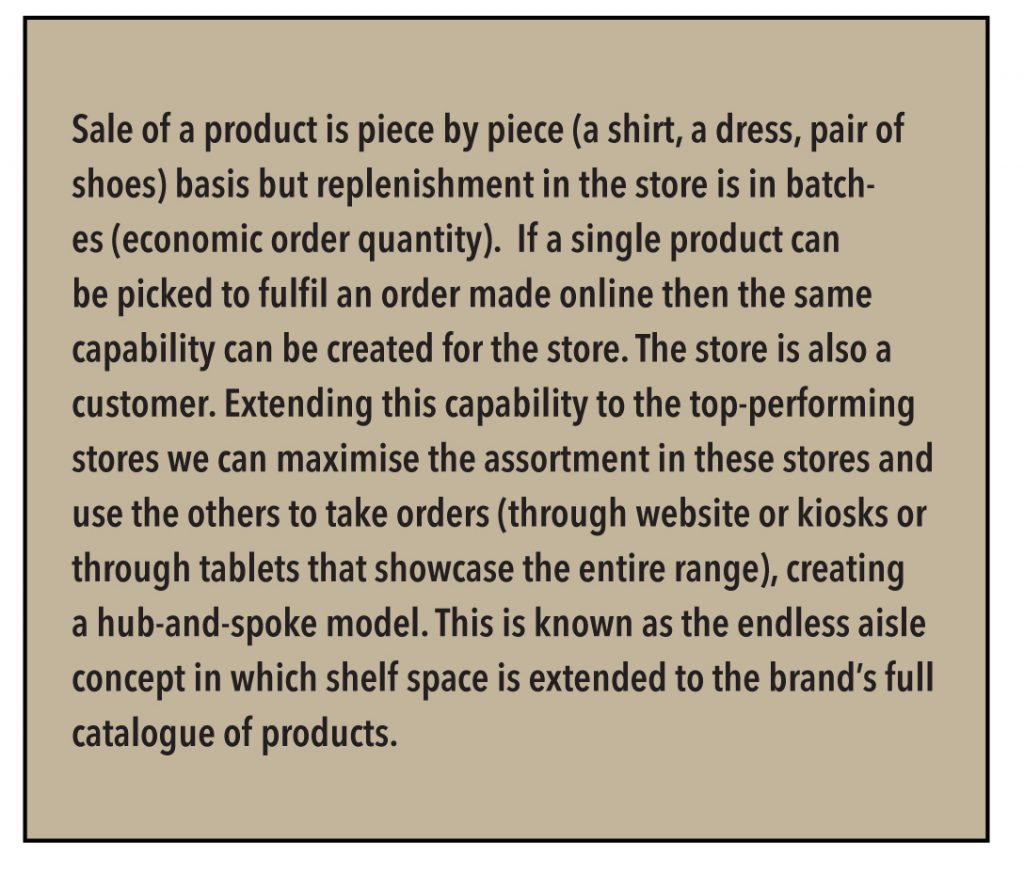

A brick-and-mortar retailer holds inventory in the store as well as at the distribution centre (DC). The assortment in the store is limited due to space constraints.The supply chain runs once a day to twice a month depending on the type of store (format, location).Hence, there is limitation to turn the inventory better. Omni-channel gives access to the product (listed on website/app) in the system, store as well as DC, to a customer — it also does this to customers who are beyond the (physical) catchment of the store and possibly where there are no stores. Thus, it helps improve the stock turns. Mr Biyani offers a deeper insight into this. He explains that, “With the omni-approach and by delivering the product to the consumer’s home, the replenishment system changes to a certain extent. We can pick a single product from the system (be it a store or the DC) to fulfil a customer’s order. Thereby, the space constraint in the store reduces and we can offer twice the assortment (variety) by cutting the depth (number of pieces) and making less of the same product available. Thus, we can improve the store performance.”

Logistics and warehousing

Logistics is easier for a store network. “Shipping from a store is cheap,” says Mr Vinay Bhatia, Head of Ecommerce & Customer Loyalty Program, Shopper’s Stop. Mr Basrur of Raymond concurs and says, “Delivery times are dramatically cut short and are at lower costs as deliveries can be made by the nearest store as there are logistic partners in place. From logistics perspective, there will be cost savings. If the product is there in the city, then it will get dispatched locally.”

Most retailers would be keen to popularise click-and-pick, which essentially means that the customer can buy online and opt to collect it from the nearest store. It helps the customer get the product quicker — more so if it’s already in a nearby store. A customer is also likely to make more purchases when he or she comes to the shop to collect the order. And of course, there are no shipping costs.

While click-and-pick would be an ideal scenario, it is a function of reach. Not all chains are present across most places in India, and the reality is that to satiate demand from locations where there are no stores or distribution centres, third-party logistics will have to be used. Even for orders from locations where stores are present, retailers may have to use third-party logistics to fulfil orders until the time click-and-pick gets more popular (may have to incentivise the customer). However, Mr Biyani believes that the existing employees in a store can be used to fulfil the delivery to customers in location that have stores. The only incremental cost could be the addition of a few 2-wheelers to facilitate local delivery.

Going omni channel, results in warehousing efficiencies and lower costs. Logically, by more sweating of the store inventory, warehousing needs should reduce. However, it depends on the stage of the business and the format, i.e., brand or third-party retailer, says Mr Basrur. Brands have multiple distribution channels and hence will have a centralised inventory for its online business. So initially, warehousing capacity will be high for brands — this will reduce as they go omni and the stores come into play. Departmental stores are enablers and hence stock more inventories in the store unlike brands as they have longer and diverse supply chains.

Capturing more wallet share

Mr Bhatia of Shoppers Stop states the real benefit from this strategy is from increased customer spreads as the assortment is wider. Internationally, there is enough data to show that omni-channel customers spends are twice single-channel customers’. According to IDC, multi-channel shoppers spend on an average 15-30% more with a retailer than someone who uses only one channel — and omni-channel shoppers will spend 15-30% more than multi-channel consumers.

Mr Biyani of Future Group explains how having a wider variety helps. He gives us “The Dinner Set” example:

Typically in a store we can offer 4-20 designs due to space constraints. But I can have 50 designs in the backend. So a customer may see some colours of a design on display and others on a screen or tablet in the store. If the piece is not in the store, it will get shipped from the backend where the customer will have the option of picking it up from the store or get it delivered home.

Mr Basrur of Raymond explains how Burberry has optimised this channel. “One can walk into any Burberry store and the customer can see the entire collection. One can select the SKUs online and Burberry can make the SKU available at the nearest store. Burberry has almost all of its collection in all its stores in a city. Since it is a luxury brand it doesn’t have too many SKUs – this helps.”

To go omni, brands and retailers have to make changes in the backend, technology, and above all, their strategic mind-set. Mr Bawankule of Google surmises, “Brick-and-mortar players have to make technology investments and create internet platforms. Importantly, it (omni) has to be treated as a new business or a new store in a new location.”

Integrating the existing offline business with online is a three-part process:

1.Going digital/setting up a website, thereby allowing consumers to buy online. A brand can also sell without a proper back-end. Fila sells online in India through a distributor. Managing website traffic is a function of technology capability.Most companies today rely on amazon web services or cloud services or hosted solutions for managing this. Therefore, scaling up and handling increase/spikes in website traffic is not a major challenge.

2.Centralisation of data/finance. Most of the offline retailers have IT systems that are tuned for brick-and-mortar operations. Once they start selling online, there has to be synchronisation and data has to be viewed real-time as customers buy across channels at different times of the day. That data has to be integrated into in the company’s IT system so that it knows where the stock is. Another aspect is stock movement — inventory is in the store and as it gets sold it has reflect in the system real-time so that a consumer shopping online will know if the stock is available or not at any given point of time.

How is it done? A master data management (MDM) layer is used to integrate old systems. It is essentially a middleware that talks to legacy systems sitting in the stores. The integration is not an easy process and it is not real time to begin with. ERP, designed for stores, was used for end-of-the day processing (e.g. stock taking).

3.Going omni and servicing the customer from the nearest store.

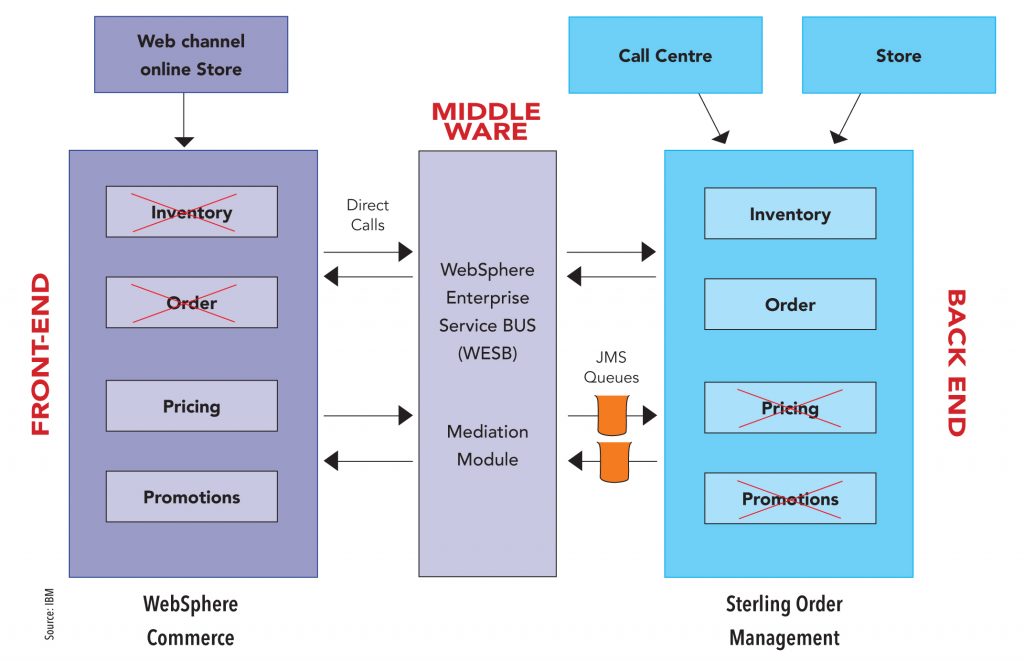

Illustration of the front end, back end and middleware for omni channel

While middleware is an important cog in the omni-channel wheel, Future Group opted for the alternative, i.e. seamless integration (no middle layer between existing systems and website) using Hybris, a SAP enterprise. A seamless interface using Hybris is possible if one is on SAP. However, not everyone is on SAP and many brands say that it is expensive in the context of their size and operations. However, for an entity like Future Group, when the number of SKUs is high, complexities of integration increase — it deals with over 40,000 SKUs (Shoppers Stop deals with 2,500), seamless integration is preferred over middleware. The others have the option of choosing different vendors for middleware and the front-end — e.g., IBM Websphere (for front end), Oracle ATG (for front end), IBM0 sterling management (middleware).

Warehousing investments

Most brands have large warehousing capabilities as they deal with multiple channels – dealers, departmental stores, franchisees. However, these warehouses may not necessarily support single-piece-picking to satisfy orders from distribution centres (DCs). They need to do so as retailers go omni and establish an online presence. Online presence can be established even before the company goes omni and to service this one would need a new-age DC that can fulfil single-piece picking. Therefore, brands may make short-term (outsource) investments in warehousing. For brands, the warehousing requirement will increase in the short term, as the online channel will be serviced through new-age DCs; but as stores come into play to fulfil orders, the requirement will come down. However, for departmental stores such as Shoppers Stop, most of the stock is in store, and its warehousing requirement will only increase when online crosses 10-15% of their topline; therefore, in the short term, it won’t need additional investment for warehousing, says Mr Bhatia of Shoppers Stop.

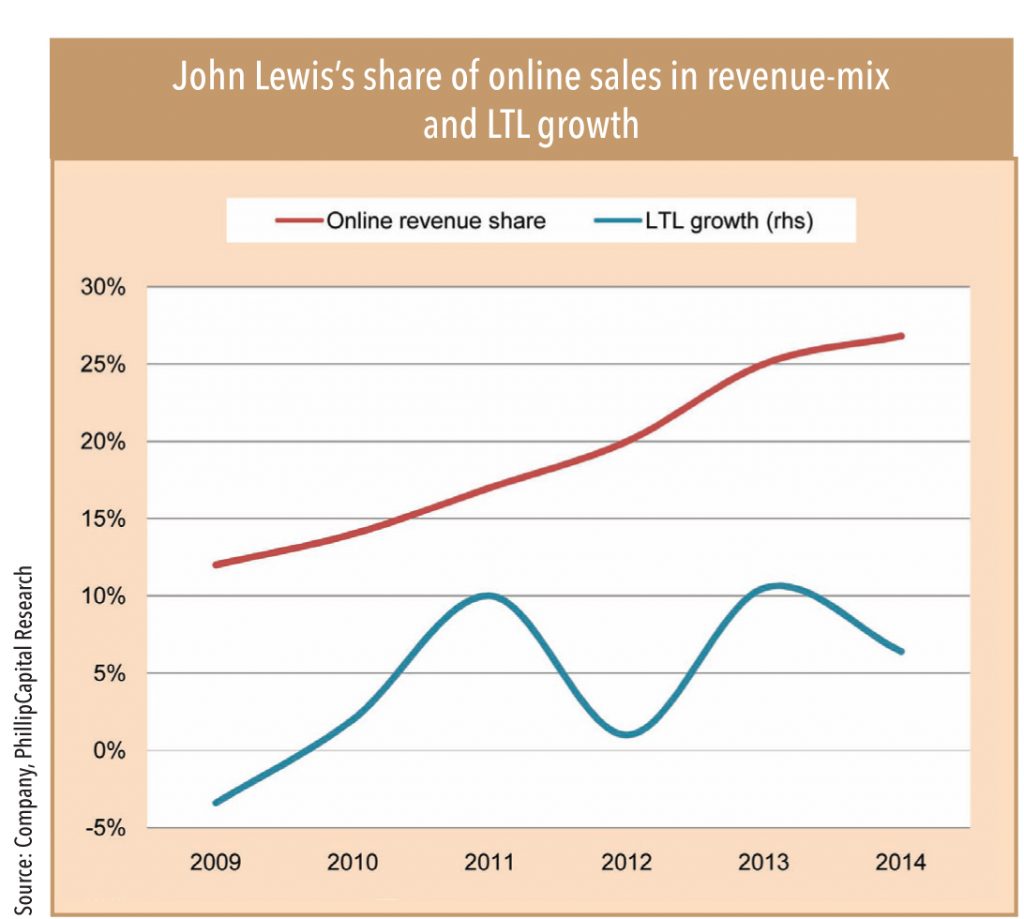

John Lewis, UK’s largest departmental store, faced competition from online players in the UK and subsequently invested in going omni. However, the journey wasn’t easy as it integrated its stores as well as Waitrose stores as fulfilment centres. John Lewis offers added incentives such as free Wi-Fi so customers can check out prices — it has a policy of never knowingly offering a price that is higher than a national high-street competitor. The extended reach of Waitrose stores (over 300) is an important factor in John Lewis’s successful implementation of omni-channel.

Things John Lewis did in chronological order:

2009 – 35% increase in the lines offered on the website;started click and collect

2010 – Increased the number of lines available and started express delivery.

2011 – Increased the number of products sold online. Invested further in the development of distribution facility. Extended services such as Click & Collect to all 29 John Lewis branches.

2012 – Online trade fully integrated into the John Lewis multi-channel operations. At the year end, ‘Click & collect’ was available in all 35 John Lewis shops and 94 Waitrose branches. Two-thirds of its shops had free Wi-Fi to enable customers to check prices as they shop. Launched over 30 new brand introductions, new own-brand ranges, and more designer collaborations. There was a £ 34.1m decline in profits as a result of the decision to ensure there was absolutely no compromise on quality, service or value for customers.

2013 – Nearly two thirds of all transactions involved customers visiting both shops and online channels. Click & collect, available in all 39 John Lewis and 193 Waitrose outlets, was a key part of this change in shopping behaviour. Orders almost doubled year-on-year, with 43% of purchases collected from Waitrose branches.

2014 – The ‘my John Lewis’ membership card was launched with 500,000 members joining in just four months. Click & collect grew by 57%, with the convenience of being able to pick up from Waitrose being particularly appreciated. Collect+ (offering click and pick at corner shops and petrol stations) was successfully launched. Visits from phones and tablets accounted for 50% of traffic to johnlewis.com.

China may be a better example than US to gauge the potential of omni-channel in India

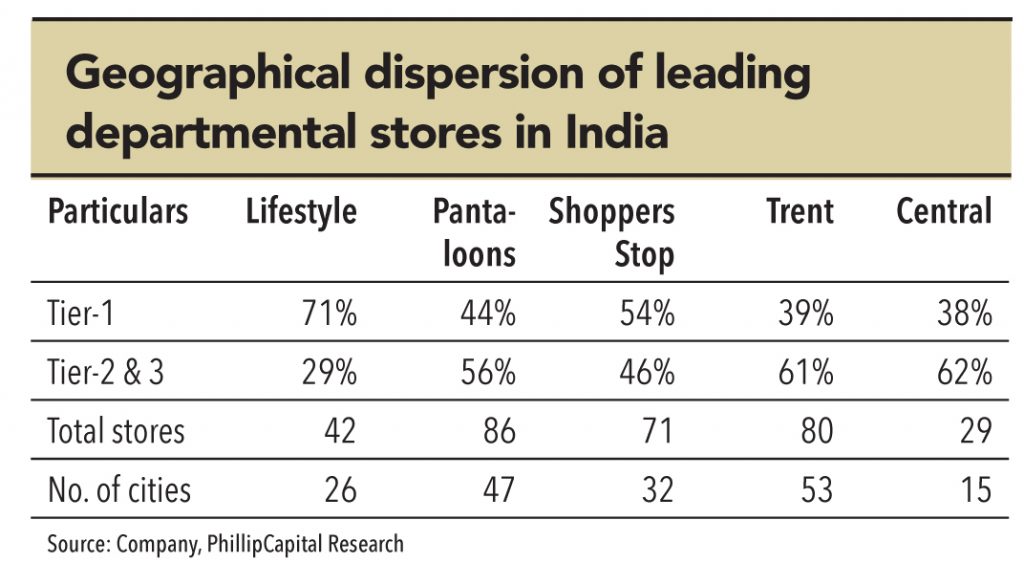

Most players and brands seem to believe that going omni is the way forward; but then, the dynamics in India are very different from the developed world. Retailers who implemented omni-channel strategy in the US and UK have successfully evolved and countered ecommerce. However, the most fundamental aspect for omni-channel is reach and stores. In the US and UK, organised retail is 80% of the market, and per-capita availability of retail assets (i.e. stores) is amongst the highest in the world. This made it easy for retailers and brands who decided to adopt omni-channel, as they are well spread out and logistically offer more convenience to customers. The reach of branded or departmental stores in India is nowhere near what it is in developed countries.

Hence, departmental stores such as Macy’s in US and John Lewis in UK have been successful — both were sizeable (high share of organised retail) when they went omni.

Subscribe to enjoy uninterrupted access