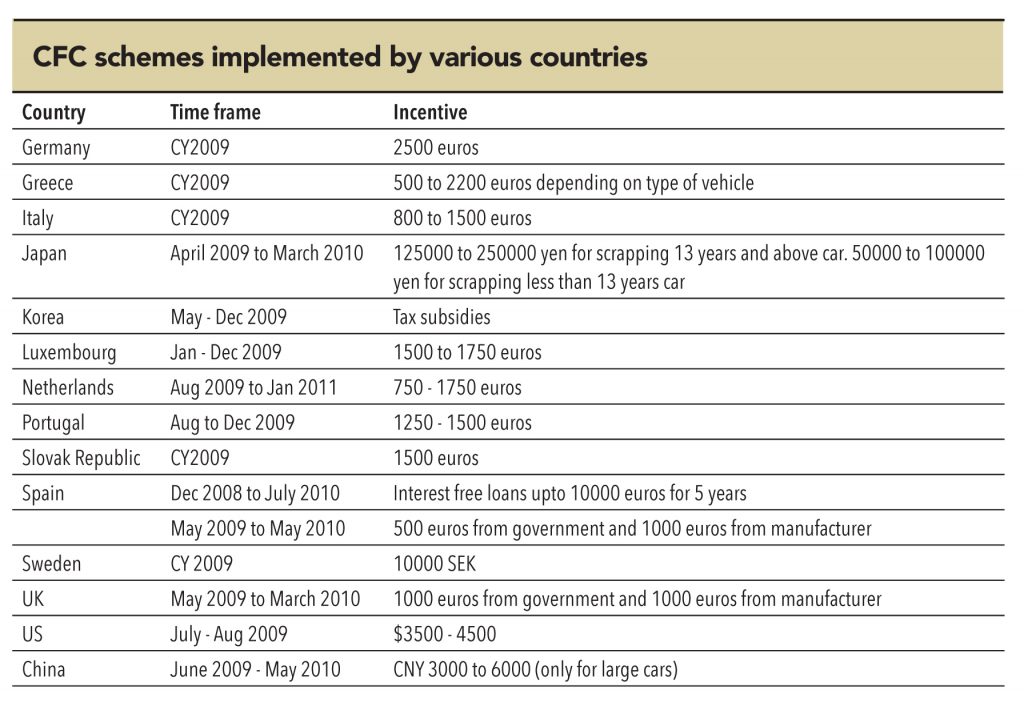

Cash for Clunkers (CFC) is a strategy used by various countries to boost ailing economies by scrapping old vehicles and replacing them with new efficient ones. While this costs the exchequer, it serves two purposes — first, it gives a short-term boost to the economy (with higher vehicle sales boosting employment) and second, it helps nations cut down on their pollution levels with the use of more fuel efficient cars. Developed countries such as the US, Europe, and Japan have implemented this during their downturn to give a short-term boost to their economies while countries such as India and China (which did it partially earlier) are contemplating implementing it. India will implement CFC to boost the ailing CV industry while China plans to implement it to keep a check on its pollution levels.

In China, about 10% of vehicles should be replaced under CFC; however, these account for 50% of pollution. The vehicles that will be cleared off Chinese roads include gasoline cars that fall below National-1 emission standard, diesel vehicles below the National-3 emission standards, and older vehicles that fail to meet the current national motor vehicle emission standards. China estimates that more than 5mn cars will be scrapped if the CFC scheme is rolled out.

CFC for India – when will it see the light of the day?

SIAM has raised a demand that a CFC-like scheme should be rolled out in India as and when the industry faces demand issues; however, actual work on the scheme started only last year when the commerce ministry proposed that the cash-for-clunkers scheme will replace 15-year-old commercial vehicles. SIAM’s proposal included CFC for cars produced before 1996 and a regular scrappage policy for commercial vehicles and 2 wheelers.

Department of Industrial Policy & Promotion (DIPP), a part of the Commerce Ministry, proposed a CFC scheme for commercial vehicles seeking to scrap 15-year-old vehicles in return of a benefit of Rs 100,000 per vehicle. They estimated the total cost to the exchequer at Rs 10bn, implying that about 100,000 old vehicles will be scrapped.

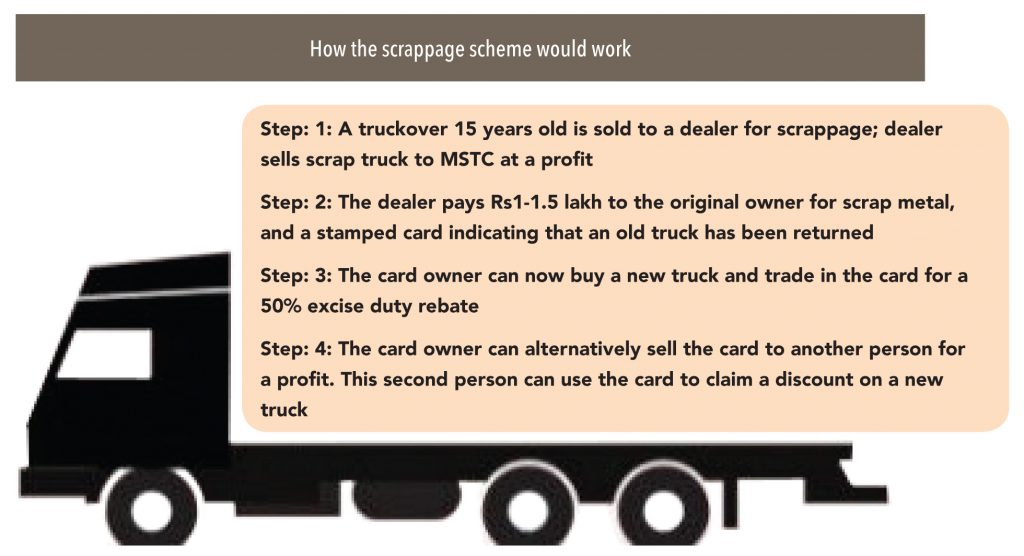

A committee headed by Mr Nitin Gokaran, CEO of the National Automotive Testing and R&D Infrastructure Project, recently submitted its report on CFC for commercial vehicles to the Ministry of Heavy Industries, which in turn will forward it to the Ministry of Finance for final approval. The report says that any truck that is more than 15 years old will be sold to MSTC for amounts ranging between Rs 100,000and Rs 150,000. The seller will get a card certifying the sale of the truck, which can be used to get a 50% excise-duty rebate on the purchase of a new truck. The truck owner can also sell the card to some other person to cash in on the benefit.

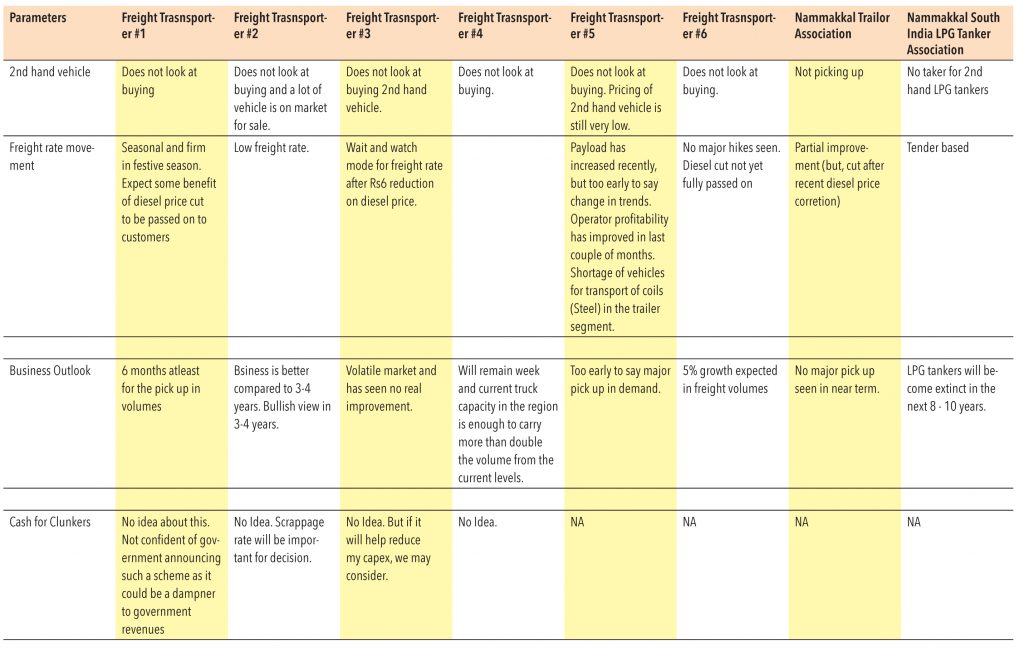

Fleet operators apprehensive about the success of the policy

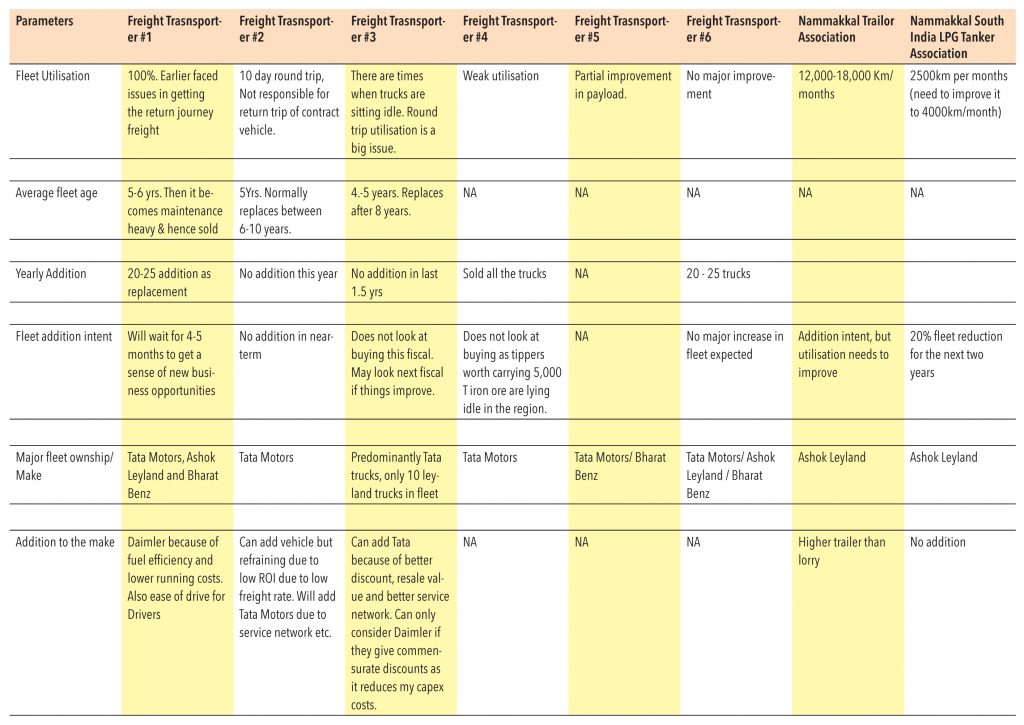

“Yeh cash for clunkers kya hota hai (what is this cash for clunkers),” said a few fleet operators while discussing the possibility of such a scheme in India.Most of them were doubtful about its success. They believe the incentives from the scheme are not good enough for a truck owner to sell their trucks and buy new ones, especially if the existing truck is in good running condition. The price realised in the second-hand market is also higher than the incentives in the CFC scheme. “Main truck kyun bechu agar woh chal rahi hai toh. Truck scrap karne ke baad nayi truck ke liye loan bhi toh lean padega (why should iscrap a running truck? Also,I will have to take a loan for the new truck after scrapping the old one),” said a fleet operator. Why would an owner burden himself with the cost of a new vehicle and interest servicing if he has a serviceable vehicle in his fleet? The scheme will only attract vehicles that are poorly maintained, believe fleet operators and vehicle dealers. Unless scrappage is mandatory, the scheme may not get the desired results.

A dealer explained, “If a 15-year-old 16-tonne truck is maintained and in good working condition, it can be sold for around Rs 300,000-400,000, whereas the benefit from the scheme is much lower than this.”

While it is difficult to ascertain the impact of the scheme and when it will be implemented,such a scheme could accelerate growth for the CV industry in the short term.

Subscribe to enjoy uninterrupted access