The current fall in oil prices is primarily due to oversupply rather than weak demand. Based on our analysis, supply-induced oil price declines have coincided with robust growth in the chemicals sector while demand-induced declines have coincided with declines in chemical-industry growth. Lower oil prices have reduced the industry’s input costs, which some companies will be able to retain in higher gross profit. Specialized products that have demonstrated strong historical pricing power (such as paints and coatings) will see the strongest margin improvement because of lower oil prices, while commodity chemicals will be the least to gain.

India is short of many critical feedstock that are needed to drive downstream domestic production. For example, ethylene and propylene, which are the basic building blocks for many downstream chemicals are majorly (90%) used for manufacturing bulk plastics. Feedstock is much cheaper in the Middle East — so petrochemical intermediates produced there are cheaper. Hence, import dependency is here to stay. This, along with other factors, has led to more investments in the chemical sector in the Middle East, China, and Singapore in the last five years, compared to India. However, just like the pharma sector, we expect the specialty- chemical industry in India to scale up rapidly in the next five years. India has the potential to become a manufacturing hub of specialty chemicals. We expect the Indian specialty chemical market to grow at 12-15% p.a. between FY14-20 and most of it will be catered to by domestic production.

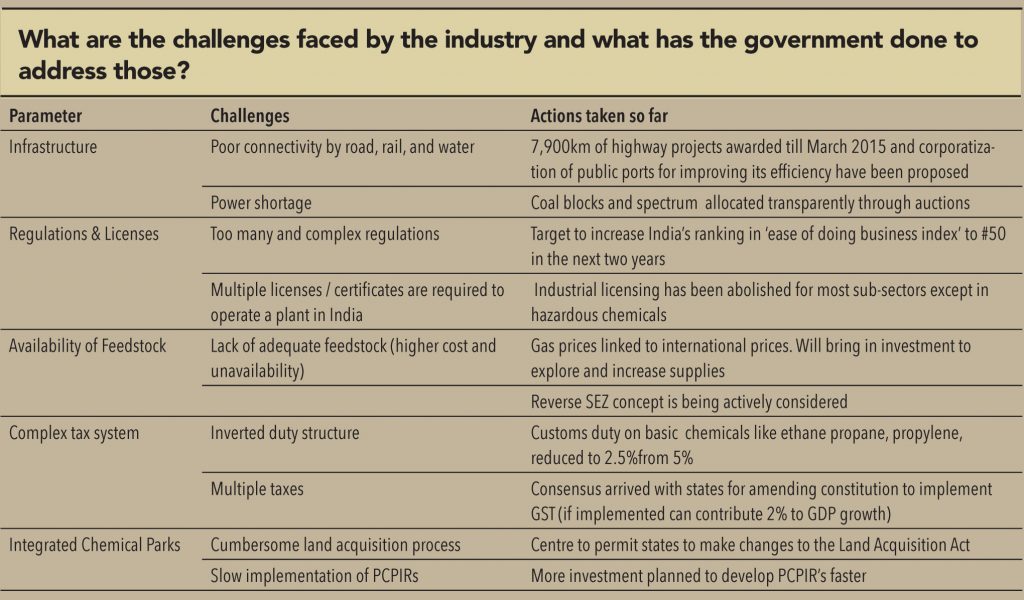

The campaign is a key initiative of the current government and its aim is to make India a global manufacturing hub. We expect the chemical sector to gain immensely from this campaign, as solid steps are being taken to promote chemical manufacturing in India. For example, coal gasification for making fertilisers, Reverse SEZ, removal of industrial licensing for most sub-sectors except certain hazardous chemicals are steps taken in this direction. The government’s target is to up India’s ranking in the Ease Of Doing Business Index to #50 (from current #142) in the next two years! We are optimistic that these challenges that the industry is facing will moderate in the next 2-3 years.

Yes, this is true in case of knowledge chemicals. Large chemical companies want to focus on their core activities and are therefore outsourcing the manufacturing of certain chemicals to Indian manufacturers. With incentives under Make in India for industry/private-sponsored research programs, we expect more outsourcing of research programs as well. With high-cost operations in the USA and Europe, the focus is gradually shifting to India due to India’s better IPR regime compared to China, cost advantage, and availability of technical manpower at low cost.

We can divide chemicals MNCs into two categories – MNCs with strong presence in India and MNCs with limited presence. MNCs having a strong presence are looking to increase market penetration and using India as an export/sourcing hub. Most of these MNCs also have R&D centres in India. MNCs with limited presence (mostly indent sales) are looking at both organic and inorganic growth options.

There are still challenges associated with manufacturing of bulk chemicals in India like availability of feedstock, cheaper imports from neighbouring geographies, high interest rates, and infrastructure problems. However, the Indian specialty chemicals industry is in for multi-fold growth in the next five years. Our per capita consumption of most specialty chemicals is among the lowest in the world. We expect this industry to reach US$85-100bnby 2025 (currently US$ 25bn). Agro chem/paint and coatings/polymers will continue to lead the pack. However, with government initiatives such as Swachh Bharat Abhiyan, Clean Ganga Project,and Smart Cities, demand for some other specialty- chemicals segments (water treatment chemicals, home care surfactants, construction chemicals) will grow at higher rates in the next five years.

Growth in demand for specialty chemicals in India will not only depend on the growth of end-use industries, but also on product penetration (consumption per capita) and specifications &standards. Specialty chemicals penetration in India is much lower compared to China. For example, spending on concrete admixtures in India is US$1.5/m3 compared US$3/m3in China. Other key growth drivers of the Indian specialty chemicals industry include strong R&D capabilities, low-cost manufacturing, and improving standards. On the downside, it is still a highly fragmented industry. However, we expect it to consolidate in the next decade.

Increasing cost of labour and power, and tightening pollution control norms, have diluted the cost advantages enjoyed by the Chinese specialty-chemical manufacturers. Devaluation of Chinese Yuan will help Chinese exporters in the medium term, but in the long term, India is in a strong position to capture considerable share of global specialty chemical exports.

The main reasons why the chemical industry in China flourished are ease of acquiring land for world scale plants, tax incentives, promotion of chemical exports by establishing export zones with hi-tech infrastructure, and availability of capital at subsidized interest rates. India is a consumption- driven economy, which holds true for the chemicalsindustry too —we have vibrant downstream industries in different segments. Also, India has the advantage of being close to ME where feedstock is cheaper. We have a strong R&D base and have the capability to produce world-class products. We also have strong presence in the export market in sub segments such as dyes, pharma, and agrochemicals. We can expect more such segments to be added in that list in the next 5-7 years.

Reverse SEZ concept was developed mainly to address our feedstock challenges. The basic idea is to develop SEZs in countries where raw material is available in abundance and at a lower price. For example, price of gas in Iran is US$2.5/mmBtu compared to US$4.66/mmBtu in India. These SEZs can be used to manufacture chemical feedstock, which can be sent to India for further value addition. The department of chemicals has proposed a reverse SEZ in Chabahar Port area (Iran) for manufacturing industrial chemicals. We can expect similar activity in Myanmar, Mozambique, etc., in the next 2-3 years.

M&A has been playing a critical role in shaping the Indian specialty chemicals industry — in the last five years, several large- and medium-sized global specialty chemicals companies have used the acquisition route to establish their presence in India. For example, in 2013 alone, there were 34 deals in the Indian chemical industry with an estimated value of US$ 2.2bn. This trend may get more pronounced provided companies adopt a proactive approach to M&A. Faster speed to market, stronger value chain presence, and product-portfolio optimization will be the key reason for companies to take the M&A route in the specialty chemicals space.

Implementation of the GST will have a significant impact and will change the manner in which business is carried out. The application of a single tax rate across all goods and service will result in redistribution of taxes across all categories. This will lead to a reduction in taxes on manufactured goods, thereby impacting pricing of the final product. Unified GST will have favourable effect on logistics cost and transit time The biggest advantage to the industry would be that of reduction in transaction cost, with an immediate impact coming from the discontinuance of CST. Multi-stage taxation, along with an inability to take full benefit of CENVAT credit/refund, has been an issue for the industry. With central GST expected to be single rate for goods and services, going forward, credit accumulation may not be an area of concern. An additional boost to the industry is if the legislation provides for carrying forward of unutilized credit.

Subscribe to enjoy uninterrupted access