The October 2015 edition of Ground View posed the question

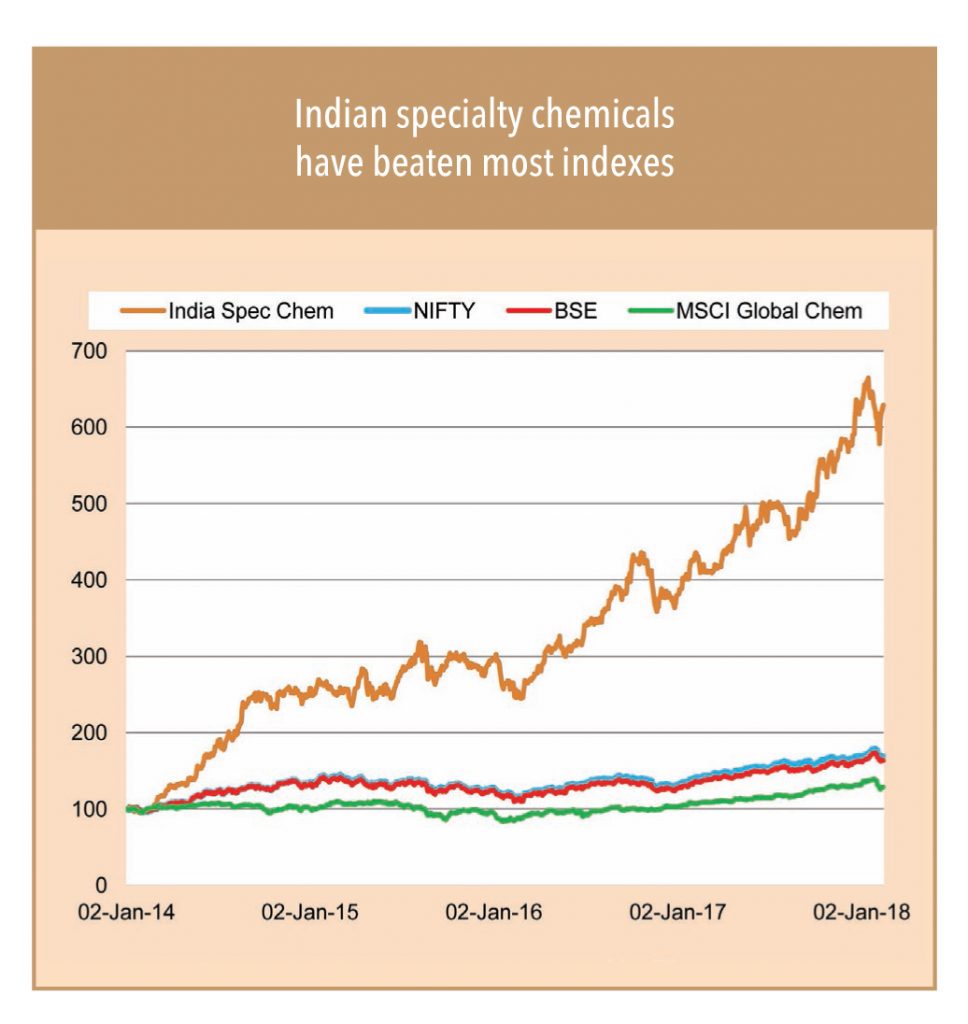

“Will the investor community continue to ignore the Indian specialty chemicals sector, with a market size of about US$ 25bn?” The best possible answer to this question was delivered by the stock market. The Indian specialty chemicals industry delivered stellar equity performance (3x returns) over the last two years. Specifically, the Indian Specialty Chemical Industry Index has delivered a 330% return since the October 2015 GV, outshining the NIFTY, BSE Sensex, and the MSCI Global Chemical index (returns of 39%/36%/31% respectively).

The equity performance was not just led by improving market sentiment, but was also supplemented by improved operating performance of Indian specialty chemicals. Over FY15-17, the Specialty Chemicals Index (represented by top-20 Indian specialty chemicals companies) saw 3% revenue CAGR (slower due to crude-price correction and a slowdown in global agrochemical demand), but the EBITDA performance was superlative with 19% CAGR. Healthy operating performance, coupled with (more importantly) strong export opportunity because of China’s slowdown attracted long-awaited investment interest in the traditionally ignored sector of Indian specialty chemicals.

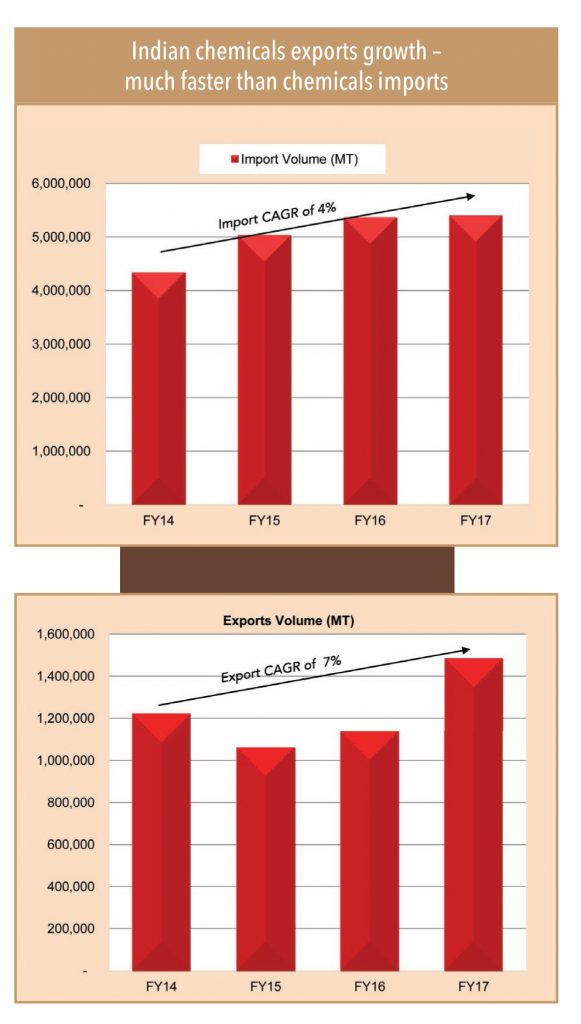

Indian chemicals exports volumes (excluding petrochemicals) grew by a robust 30% in FY17 (vs. 7% growth in FY16) to 1.48bn tonnes (18% CAGR over FY15-17); on the other hand, India’s chemicals imports were muted at 4% CAGR to 5.4bn tonnes. This is exactly in line with the last GV’s hypothesis – that the slowdown in the Chinese chemical industry, led by environmental policy restrictions, should reduce India’s import dependency in chemicals and boost export growth potential meaningfully.

Similarly, Indian exports of petrochemicals (with domestic production share of 84% and consumption share of 80%) reported 10% CAGR in volume growth at 5.23bn tonnes, but the import of petrochemicals (6.4% CAGR) remained muted over the same period at 12.1bn tonnes.

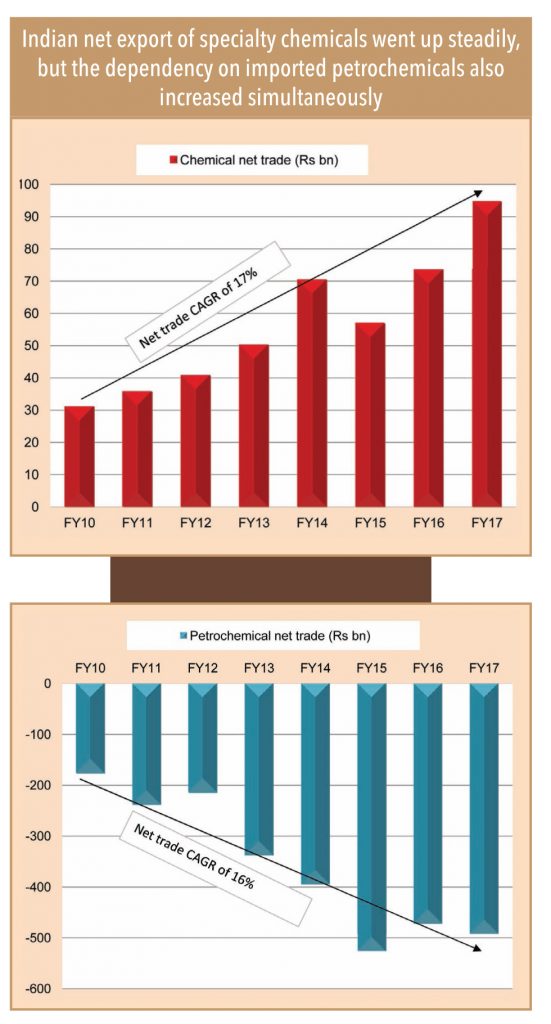

Interestingly, India is globally known as a net importer of chemicals, but this was largely due to over-dependency on imported petrochemicals. Otherwise, India has been a net exporter of value-added chemicals, or specialty chemicals other than petrochemicals. India’s net chemicals exports’ CAGR over the last seven years was 17% (touched Rs 95bn in FY17, robust 29% CAGR over FY10-17). The country has remained a net importer of petrochemicals, which is an enabler for specialty chemicals as it provides all the feed-stock. India’s net petrochemicals exports, in line with the rising net exports of specialty chemicals, saw a CAGR of 16% over the last seven years.

The recent steady appreciation in crude prices and input materials has elevated concerns about investments into chemicals. In this context, Mr Suyog Kotecha,Partner, McKinsey and Company said: “The Indian specialty chemicals industry will see a CAGR of 12-15% to touch US$ 110-140bn by 2025. India seems the only bright spot globally for strong growth in the chemicals market. Drivers that makes India the fastest-growing chemicals industry in the world are – emergence of the country as an alternate hub of chemicals manufacturing to China, low-cost advantage, respect for intellectual property, and MNCs’ focus on de-risking their sourcing from China.”

“The Indian specialty chemicals industry is set to sustain healthy growth momentum led by advantageous domestic demand, strong GDP, and rising per-capita income.”

Mr K. A. Ramakrishnan, Head of Chemical Practice and Partner, Avalon Global Research

Subscribe to enjoy uninterrupted access