Is compulsory hallmarking the last nail in the coffin for small jewellers?

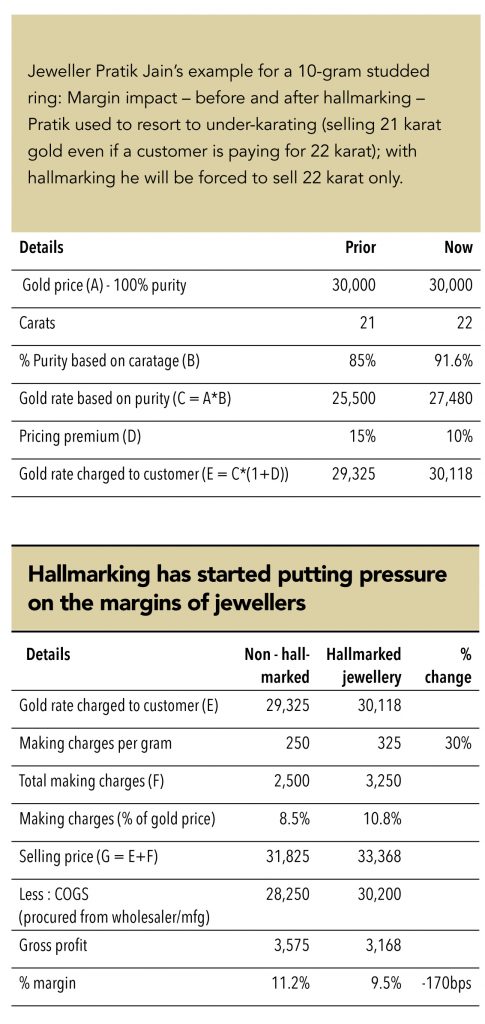

Said Pratik Jain, 35, a small jeweller from Mumbai, “Increased awareness on hallmarking has already started affecting margins, as earlier there was a lot of under-caratage.” Before hallmarking, by charging lower making charges vs. organised players, he was able to attract customers within his catchment area, despite lacking in terms of design and variety. However, with increased demand for hallmarking, he has increased making charges on a per gram basis by an average 30% in order to compensate for loss of profit from under-cartage. Despite this, his gross margin has come down by 150-200bps in the last one year. Satish Chand Singhvi, President of the Delhi Jewellers’ Association concurs with Pratik Jain’s view – that jewellers will incur a cost on hallmarking, which they will invariably pass on to consumers.

“Once the government imposes mandatory hallmarking of gold, over two lakh (200,000+) jewellers would virtually be eradicated from the industry. Today, consumers are also swayed by the modern designs and lightweight options offered by organised retailers.”

-Surendra Mehta, Secretary of Indian Bullion and Jewellers Association

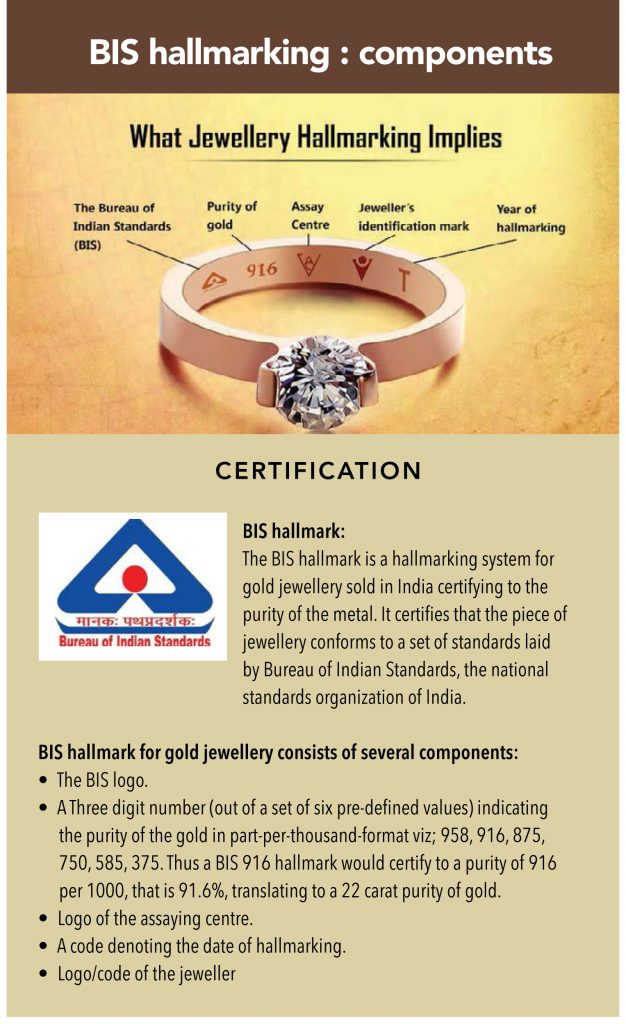

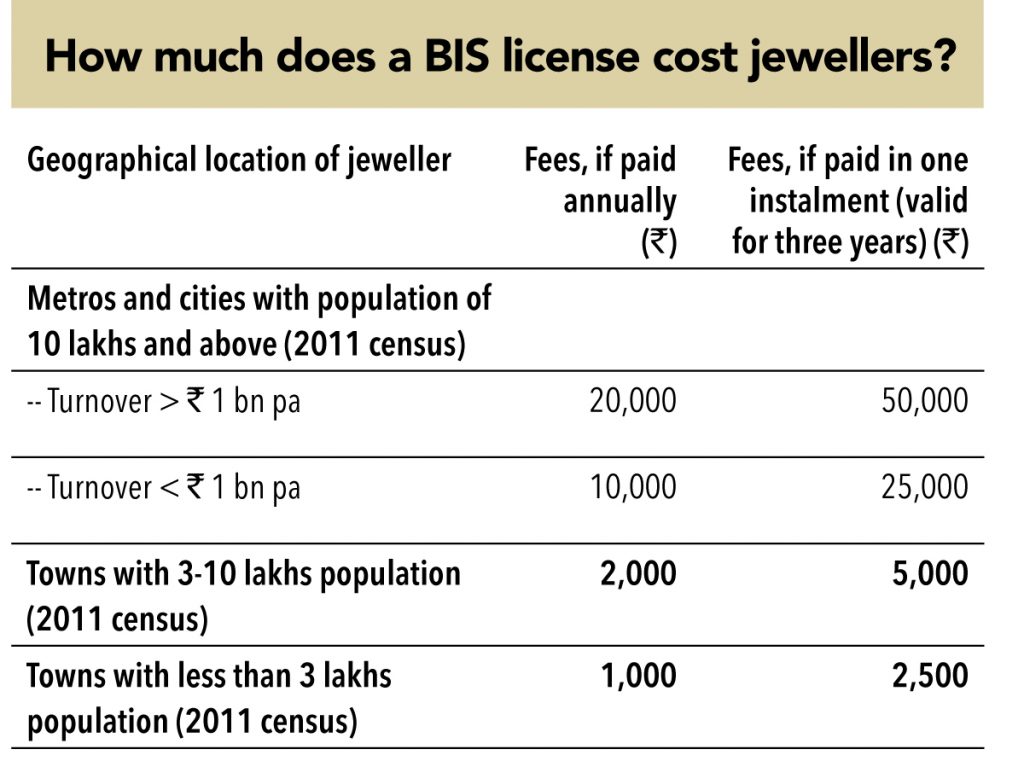

However, hallmarking on its own is not infallible – in order to develop gold as an asset class, all stakeholders in the supply chain (bullion dealers, manufacturers, wholesalers and retailers, and hallmarking centres) have to comply with norms laid down by the Bureau of India Standard, 2016. In any case, most small jewellers who have gradually started selling hallmarked jewellery over the past few years are not following the norms in their ‘true spirit’. Most small jewellers do not have a BIS license, which is pre-requisite for selling hallmarked jewellery. They only put the ‘916’ mark on a piece of jewellery, which is not compliant with the law.

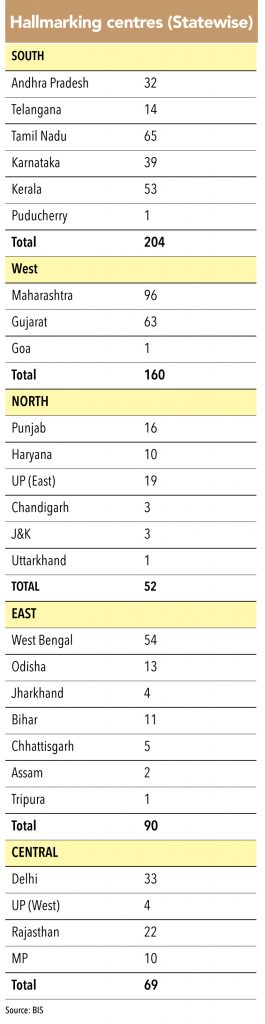

Underutilisation makes matters worse for hallmarkers

Hallmarking centres require a high initial investment of 100-150mn and these are currently operating at lower utilisation levels of only 15-20%, as a lion’s share of unorganised jewellers have yet to move to hallmarking. Because of this, these centres have begun providing their services to jewellers that do not have a BIS license. This makes it an unaccounted business on the hallmarkers’ books (they escape the 10% royalty payable to BIS); they resort to this in order to recover their monthly operating expenses of 300,000-350,000.

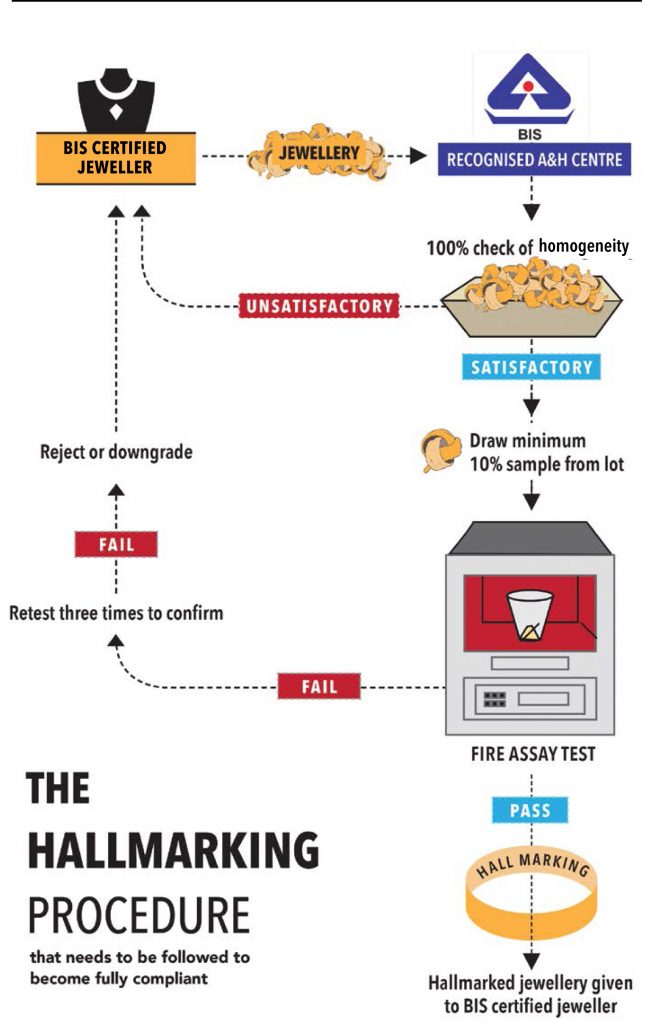

Ideally, hallmarking should take 4-5 hours for a single piece of jewellery. However, most hallmarking centres are completing the process in 10-15 minutes by skipping the fire-assaying test. With 60% of hallmarking centres located in densely concentrated jewellery-manufacturing zones, high competition and undercutting complicates matters even more.

Vicky Bafna, 28, who runs a jewellery shop in Virar, a busy suburb on the outskirts of Mumbai, highlighted that he does not have a BIS license (a pre-requisite for selling hallmarked jewellery), but can get his jewellery pieces hallmarked from certain hallmarking and assaying centres. He intends to take a BIS license only when hallmarking becomes compulsory. He also acknowledges that other jewellers might not accept his hallmarked jewellery, because it is not fully compliant. Vicky puts only a “916” stamp and ignores other components because a hallmarking centre cannot write the name of a non-compliant jewellery shop.

Making hallmarking mandatory for manufacturers is a possible solution

Harshad Ajmera, President of Indian Association of Hallmarking Centre has a solution. “If hallmarking is made mandatory at the manufacturers’ ends, it will resolve most of the issues for retailers”, he suggests. He also said that BIS can conduct surprise audits at hallmarking centres on a regular basis and if a centre is found culpable, its registration should be revoked.

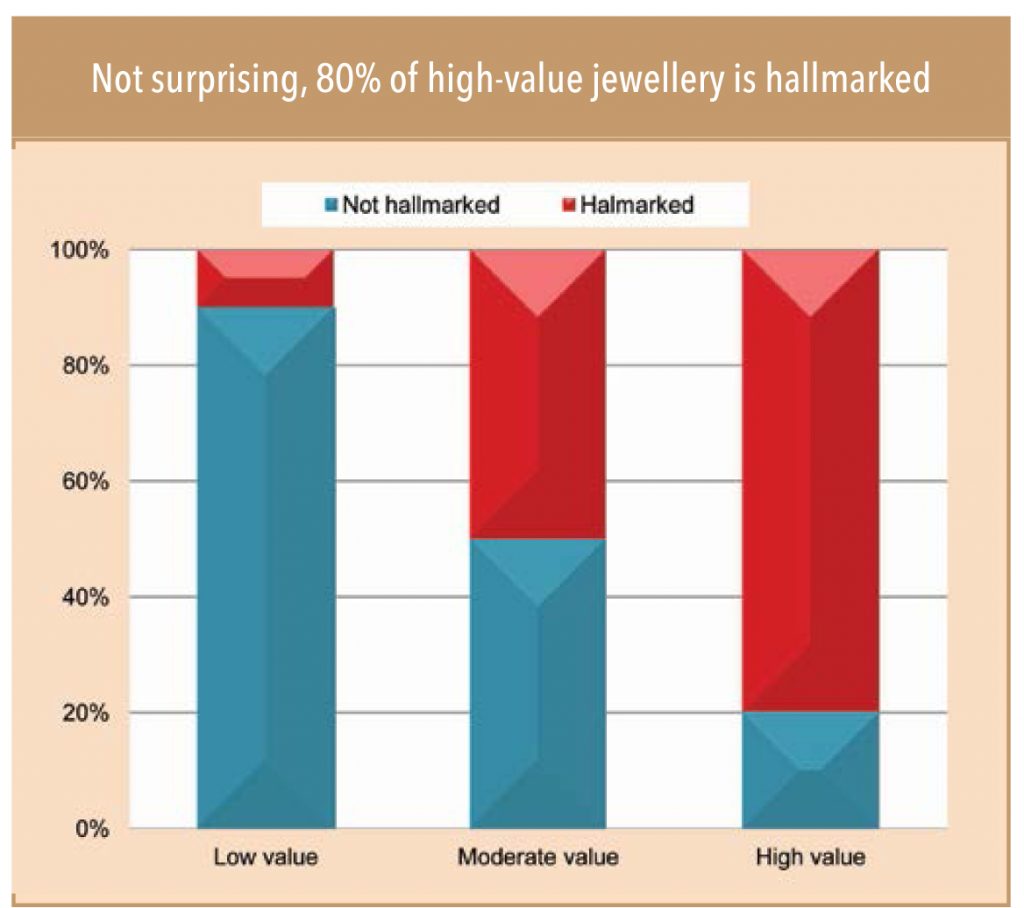

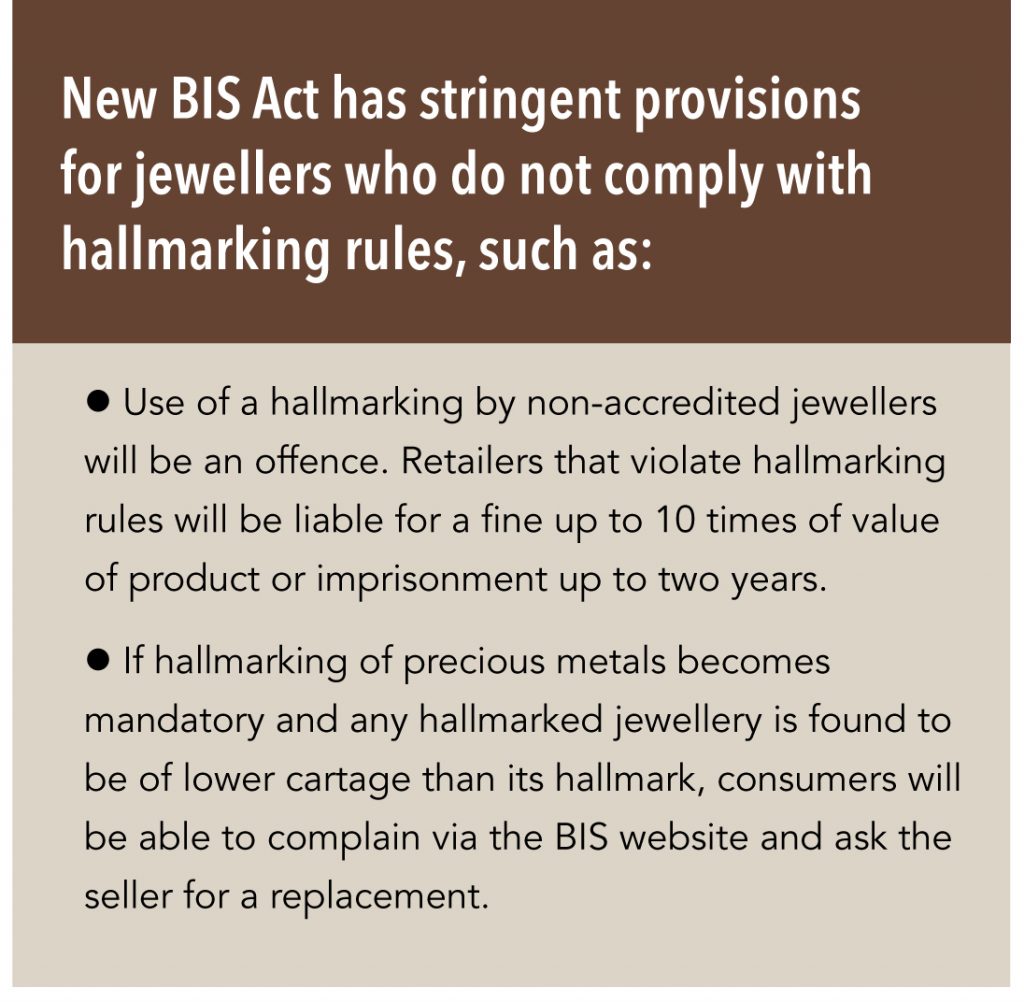

15,000. Moderate value: 15,000 to 50,000. High value: more than50,000 (per article at current gold prices) Source:: WGC Hallmarking ReportHallmarking is likely to herald a new era in the Indian jewellery sector and will accelerate a shift to organised jewellers as customer prefer national/regional chains over smaller local stores. This is because the former offer better designs and quality. Once hallmarking becomes mandatory, it will become difficult for small jewellers to escape stringent provisions.

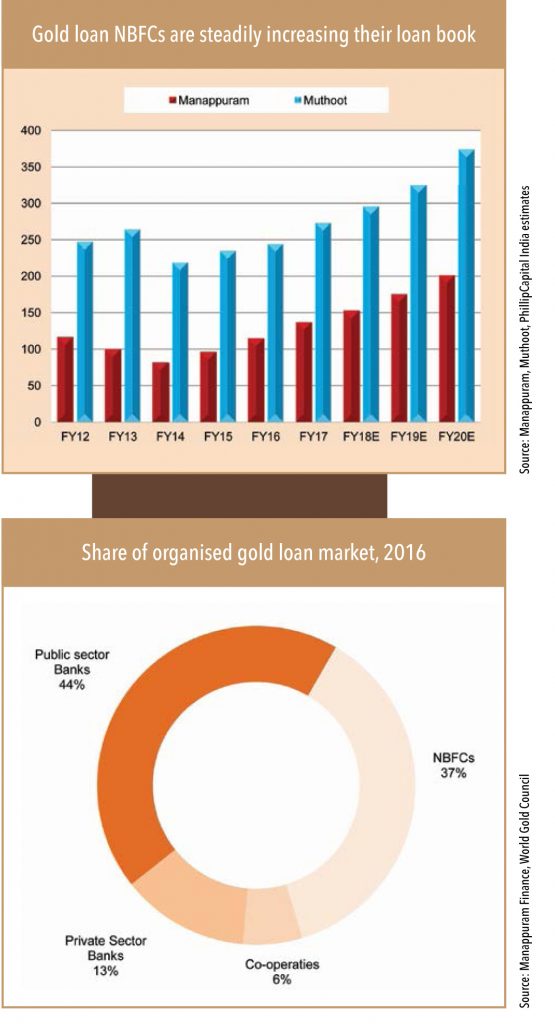

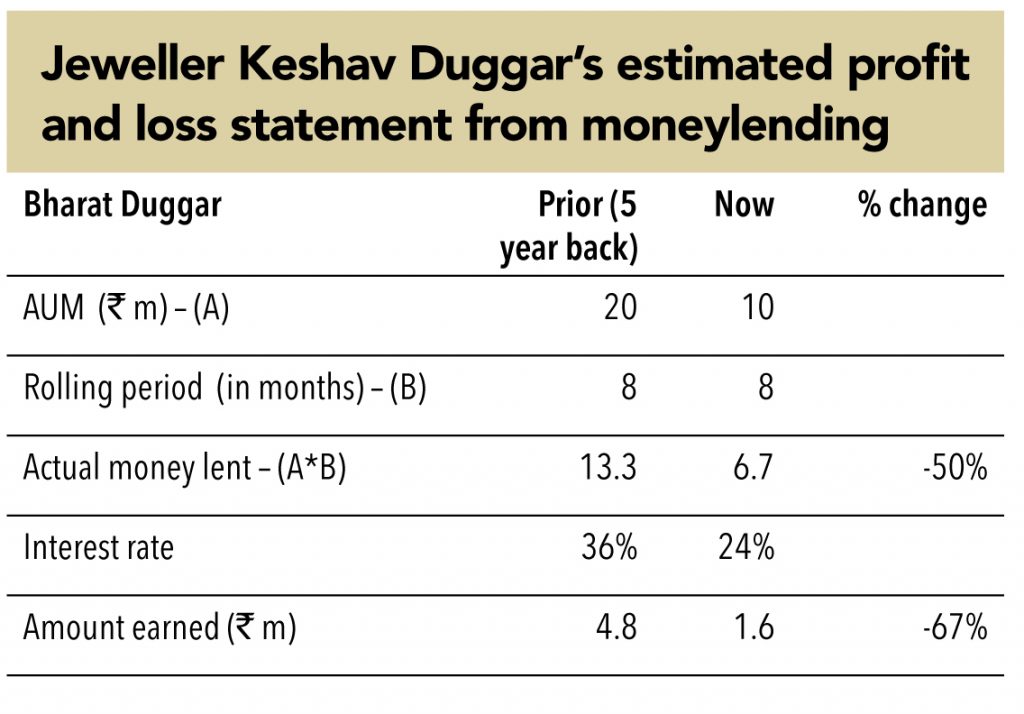

For small jewellers, money lending is faltering Not only has it not rescued them, it is coming under increasing pressure. With jewellery demand remaining stagnant since the last few years due to various regulatory measures, and hallmarking becoming mandatory in time, small local jewellers were banking on their money-lending businesses for growth. Generally, 30-40% of small jewellers’ net profit comes from this business, which is now facing survival issues due to increasing competition from gold-loan companies and emerging NBFC companies.

Is hyper competition killing the golden goose (the moneylending business) of unorganised jewellers?

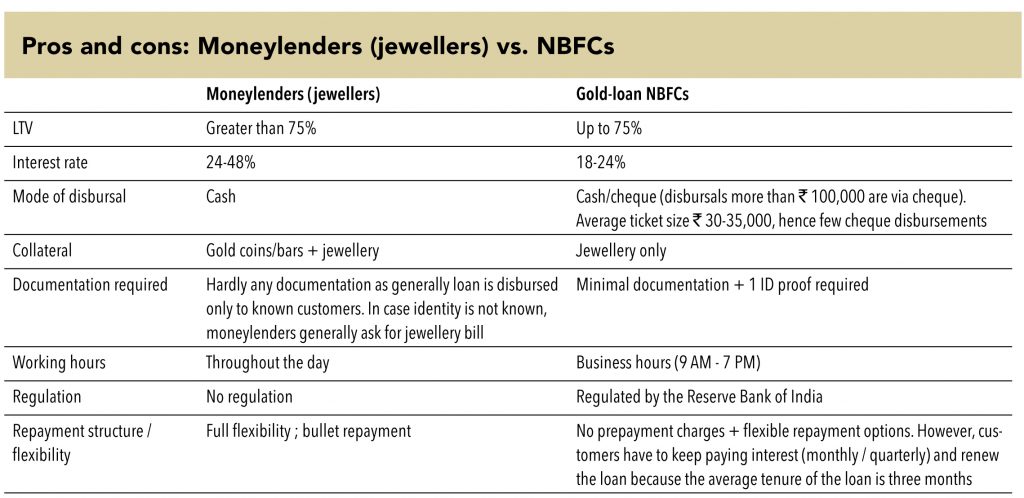

Keshav Duggar, 42, who runs a wholesale shop called NK Jain Jewellers at Big Bazaar Street in Coimbatore, said, “Takey ke dhande ki bhi waat lag gayi (the money lending business is also ruined).” For Duggar and his comrades, this business has fallen by 30-40% over the past five years due to increasing competition from gold-financing companies, NBFCs, and even banks. Gold-financing companies (such as Muthoot and Manappuram Finance) have made a big comeback in 2015 when the RBI raised LTV (loan-to-value ratio) to 75% from 60%, creating a level playing field between banks and gold loan NBFC, since banks offer gold loan at an LTV of 75-80% .

The only advantages, said Keshav Duggar (not very enthusiastically), are that small unorganised jewellers can disburse faster with less documentation vs. organised players (such as gold-financing companies) and that they can lend against gold coins and bars (while gold-financing companies lend only against gold ornaments). “However, consumers from the lower strata of society generally do not have gold coins or bars and they generally own only jewellery,” he added. Often, gold loans are taken for working capital; hence, this business also has remained subdued for a while since SMEs continued to face the heat due to GST implementation and demonetisation.

Formal employment, cashless medical policies are hurting money lending

Vinod Jain, 34, who runs a jewellery shop called Jain & Sons (name changed) in Mahim, Mumbai, said that borrowers draw funds either for medical emergencies or for buying consumer durables in the festival/marriage season. “If customers do not have an immediate need for funds, they will never come to us; gold-loan companies and NBFCs can offer loans at much cheaper rates,” he declared.

More potential customers (generally from the lower economic strata) are joining the formal economy, at least in urban areas, according to small jewellers. As a result, these potential customers are getting cashless medical insurance from the companies that they work for, thereby reducing their need to borrow funds from moneylenders for medical emergencies.

The Government of India plans to launch a mega insurance cover under “Ayushman Bharat”, which intends to provide insurance cover of ` 500,000 (including pre- and post-hospitalisation cost) to over 100mn families. If this scheme is implemented and executed well, it will further reduce the need for borrowing money from small jewellers.

Micro-finance banks provide loans without collateral to borrowers, hurting moneylending

Chandan Dutta, 26, who runs a jewellery shop at Barrackpore, West Bengal, said that he has been forced to reduce his interest rate to 2% per month from 3% since Bandhan Bank expanded very aggressively and started group lending (which is actually individual lending, since other borrowers in the group are guarantors) without asking for collateral. He believes that competition may intensify as Bandhan plans to go for gold-loan, two-wheeler loans, and affordable housing loans after fund raising via IPO. He even quoted Game of Thrones to describe his circumstances – “Winter is coming”, he quipped.

Will the moneylending segment of gold jewellers survive?

Small jewellers’ money-lending business is likely to come under threat in coming years due to collateral free lending from micro-finance companies and new-age fintech companies, and lower interest rates/better service offered by gold-loan NBFCs. Visits to the branches of Capital First and Bajaj Finance in Mumbai revealed that to avail an unsecured personal loan, one needs to have proper documentation (Form 16 for salaried individuals and ITR return/gumasta license for professionals/business persons). PAN and Aadhaar are mandatory for most loans.

Fintech companies and P2P (peer-to-peer) lending platforms (using data-analytics capabilities) are likely to capture significant share from unorganised small jewellers, as borrowers from even the lower economic strata in urban areas have increasingly started using smart phones (with data rates dropping sharply). These companies will give loans without collaterals.

“We are the first NBFC to meet the challenge arising from demonetisation. We introduced several digital initiatives for disbursement of loan as well as for collection of interest and principal. Indicatively, in response to the currency crunch faced by customers, we introduced POS machines, prepaid cards, co-branded prepaid cards, IMPS, RTGS/NEFT for disbursement of gold loan, and the mobile app ‘iMuthoot”. All these were welcomed by our customers, and the quantum of digital transactions has improved manifold.”

– George Alexander Muthoot, MD, The Muthoot Group

“Over the medium and long term, we expect players in the unorganised sector to concede ground to the organised sector, which will benefit us. We also expect gains for our On-Line Gold Loan (OGL) product, which is totally cashless at our end.“

– VP Nandakumar, MD, Manappuram Finance.

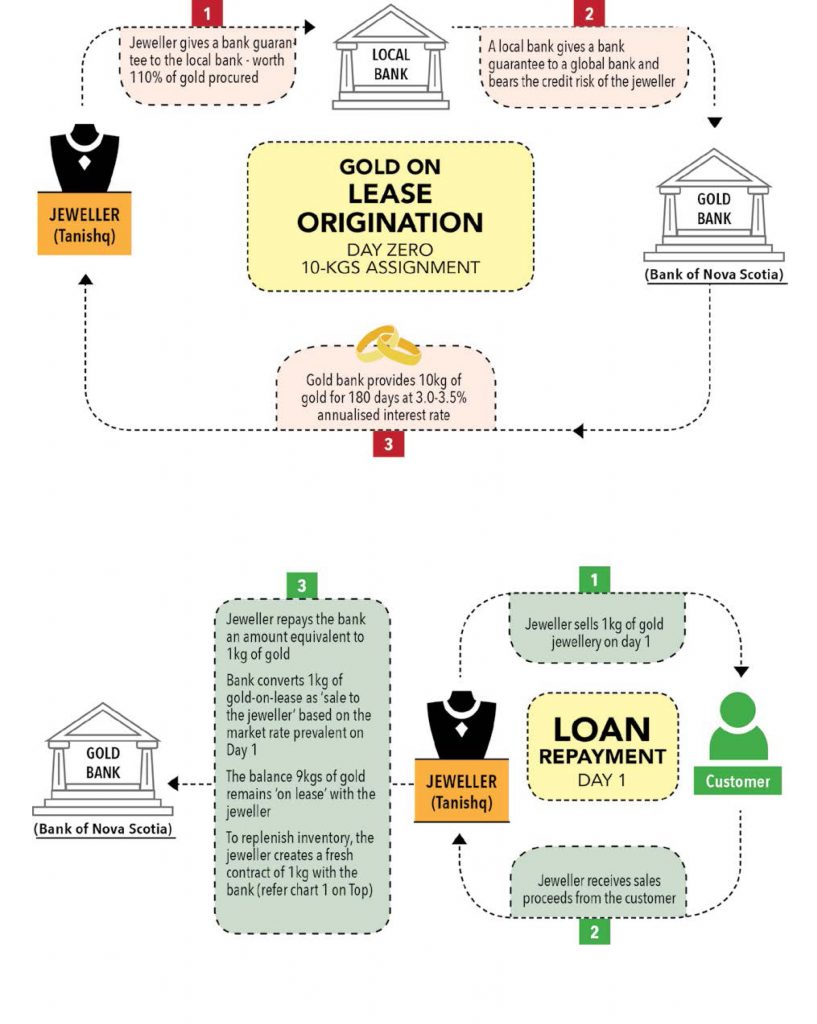

Why don’t cash-rich small jewellers use gold on lease to expand?

Despite small jewellers having a healthy financial position, they are unable to procure low-cost gold on lease, as banks are not willing to lend to them due to the unfavourable risk-reward ratio because of their small ticket sizes and majority of transactions happening in cash. With weaker balance sheet (as only fraction of the business is accounted in books) and hesitation from highly conservative second-generation family members to take any form of credit, smaller jewellers do not take gold on lease to expand their businesses.

Vicky Bafna, 28, a jeweller from Virar (Mumbai’s outskirts) scoffs while explaining, “Hume kaun paisa dega jo Nirav Bhai ne khand kiya (who will lend us money post the Nirav Modi fiasco).” Kevalchand Bafna, 57, his father (sitting beside him) seconds him saying, “Hume bank ki magajmaari me nahi padna hai and aur dukhan ke kaagzaat girwi nahi rakne hai (I do not want to take any credit from bank and keep property related documents as collateral)”.

Most of the national and regional players have been able to scale up their business operations in the last few years using low-cost gold on lease (at 3.5-4.0% annual interest). Majority of the investment required towards setting up a store are towards inventory (95%); so availability of low-cost working capital loan makes a lot of difference.

Sabarinath, Chairman of Coimbatore Jewellers Association highlights – “Small jewellers have lagged behind and have not been able to avail of low-cost funding from banks due to two reasons: (1) proper books of account are not maintained, and (2) second-generation hesitation to take any form of bank credit. On the other hand, banks are also not willing to lend money to small jewellers as they do not meet risk-return criteria due to smaller ticket sizes, since most of the transactions for these jewellers happen in cash and banks are not willing to take any risk due to very low rates of interest (3.5-4.0%).”

One of the senior executives from India’s leading private sector banks explained – “Indian banks do not have much gold on their balance sheet to lease out, and in the most cases, they are operating as facilitators (guarantor) for foreign banks. Indian banks get only 1/3rd of the total interest charged to jewellers (Indian banks earn 1.0-1.5% per annum mainly as guarantee commission) with the balance going to foreign banks (2.5-3%).” As a result , banks do not show much willingness to push this product. Moreover, they are risk-averse as far as lending to small jewellers is concerned.

“There is a lot of difference between big and small manufacturers since large players are able to get gold metal loans at low interest rates.”

-Nilesh Gupta – President of the Skill Development Council of the IBJA

“This is a serious issue. Manufacturers are losing out on margins and terms of payment. This process will put jewellers under stress. There is an immediate need to extend loans to small jewellers. Gold and rupee deposits too need to checked”

– Surendra Mehta, Secretary, IBJA

“Larger retailers have big showrooms, and they issue advertisements and get a lot of benefits from the government. Small retailers play on their own. Banks are charging 120-150 per cent collateral for letters of credit after the jewellery scams that happened recently”

– Kumar Jain, vice-president, Mumbai Jewellers Association

Smuggled contraband gold being cheap – the biggest myth

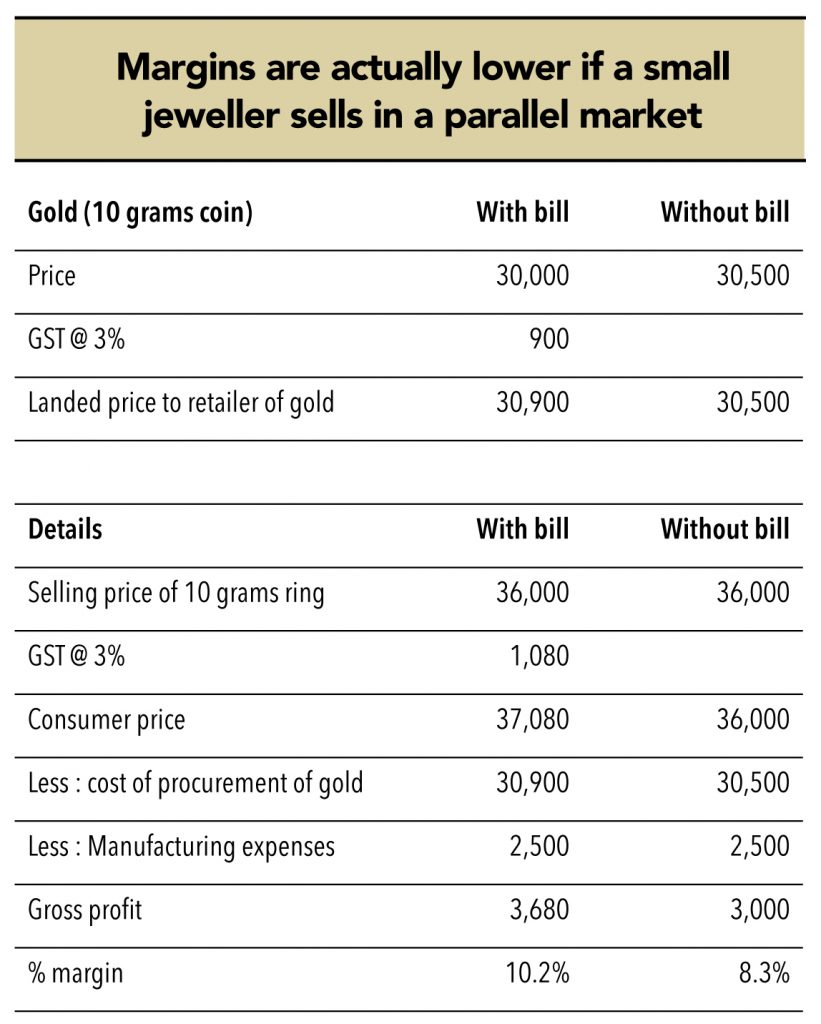

The popular belief is that small jewellers (flushed with unaccounted money) are able to easily procure low-cost gold from illegal channels. However, checks revealed that smuggled or contraband gold is actually costlier (despite hefty savings of 13% on taxes) than gold procured from authentic or verifiable sources.

Pratik Jain from, Kshitij Jewellers puts it very simply – “Gold is a liquid asset and is equivalent to cash; hence, unorganised jewellers / manufacturers get only discount of 1% on smuggled/contraband gold vs. the market price, which includes 3% GST. Additionally, most small jewellers do not stock smuggled gold due to fear of being nabbed by authorities.”

Additionally, unorganised jewellers earn lower margin if they sell jewellery made out of smuggled gold bars since they cannot avail of the ‘setting-off of input tax credit’. Pratik Jain says – “In some cases, customers come to the shop, select a piece of jewellery, and only then they say they do not want a bill. By then, we have already quoted a selling price, and we are not in a position to change this price. We have to sell the selected jewellery despite receiving lower margin (because we have already paid GST on the selected gold/jewellery, which becomes a cost to us). We do this because of higher competition – others are willing to sell without a bill.”

Market perception that small jewellers have an advantage over organised players in terms of procurement of gold is completely flawed; they are afraid to procure unaccounted gold because of the constant threat of raids by regulatory authorities

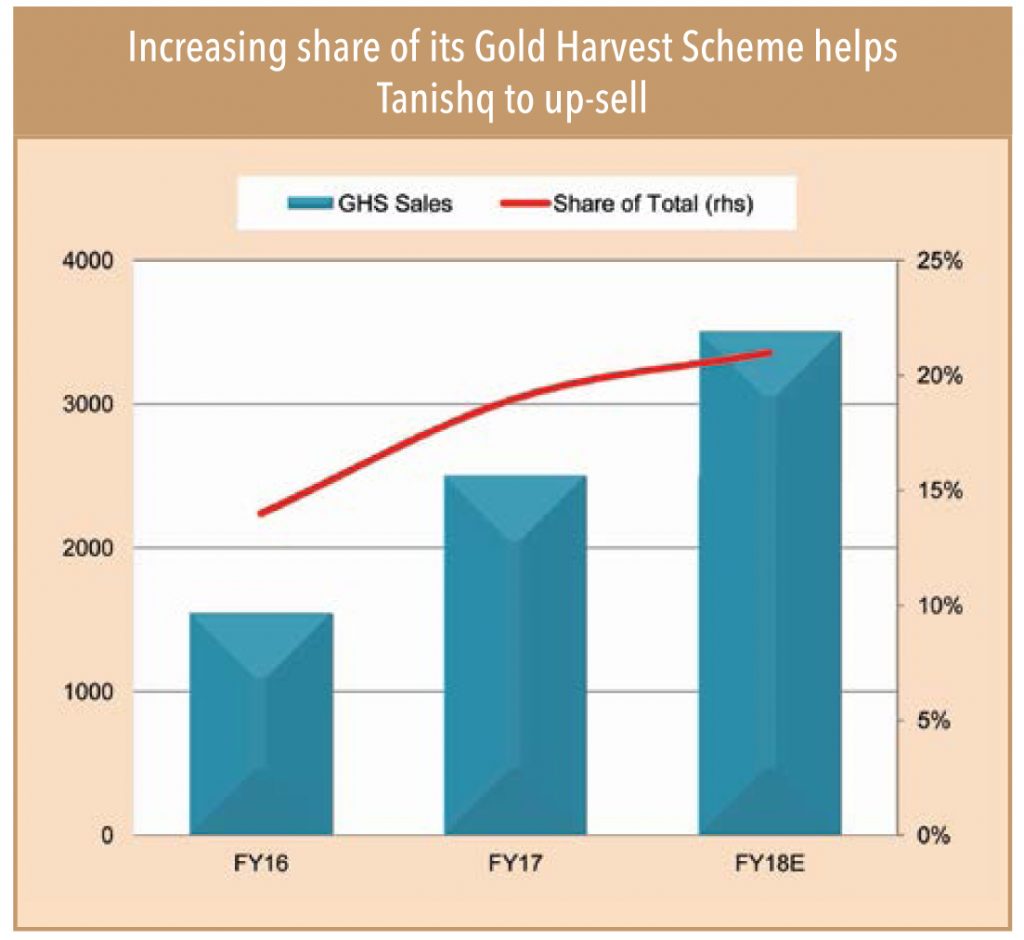

Tanishq derives c.20% of its revenue from its ‘Golden Harvest’ gold-deposit scheme. Small jewellers (which derive 10-15% of sales from such schemes), are generally run by partnership firms or proprietorship structure; do not face the restrictions that organised jewellers face under Deposit Regulations of the Companies Act, 2013. Even with this advantage, small jewellers are not very keen on pushing sales via these schemes, as they do not want to get involved in the paperwork (for every deposit they will have to issue receipt and maintain records). Besides, there is the issue of trust – Chandan Dutta, 26, who runs jewellery shop in Barack Pore, West Bengal, revealed that customers are not very comfortable with deposits to small jewellers, as there have been instances of fraud/theft. Small depositors have lost confidence in such schemes after the Saradha and Rose Valley scams at least in West Bengal.

Unregulated Deposit Bill will benefit listed organised players

The government is planning to pass the ‘Unregulated Deposits Bill’ in Parliament, which will prohibit jewellers from taking unregulated deposits that are not in compliance with rules and regulations of the Companies Act, 2013. Discussions with the management of Titan and TBZ, suggested that their business will not be impacted since their deposit schemes are already regulated.

“It seems that the Bill is being brought in to not only protect investors from ponzi scheme, but also to ensure that such deposits are regulated through a proper banking channel to strengthen banks’ working capital. This will force jewellers to approach banks for financial requirements, making them more accountable and prevent diversion of funds,” said Surendra Mehta, secretary, India Bullion and Jewellers Association.

Jayantilal Challani, president, The Madras Jewellers & Diamond Merchants Association, said, “It would not be right to completely ban deposits for the mistake of a few people. Almost 20 per cent of the jewellery business is through savings schemes, which offer better rates than banks. It is a win-win situation for both the jeweller and the customer. The industry is becoming more organised, especially after the GST roll-out. The deposit schemes could be regulated, but should not be banned.

Fragmented land holdings ‘concept’ prevails in the jewellery sector as well

In India, most small jewellery businesses are operated by joint families, and the personal expenditure of each member is met by funds that this business generates. There are many claimants – and education/marriage related expenses of each family member eats away a significant amount of profit, leaving less capital to invest in the business.

Jeweller Pratik Jain has two younger brothers, and they all are involved in the business. He says, “As our family grows, separation becomes necessary. The patriarch of the family has to arrange funds for setting up jewellery stores for his children in nearby areas. When that happens, because inventory is generally bought upfront, it becomes difficult for the erstwhile store to scale up business operations”. This situation is similar to farmers’ fragmented landholdings when due to of a division of land because of family partitions, it becomes unviable to carry out farming operations.

Gen-next not interested in running the show

Yogesh Chadawar, 55, a small jeweller based out of Ujjain, Madhya Pradesh, seemed frustrated. He said, “Mai aapne beta ko phadha raha hu, is dandhe mai kuch bacha nahi hain (I am trying my best to educate my son as there is nothing left in this business. Then he won’t have to carry forward this legacy business.)” He reckons that after accounting for all opportunity costs such as rent earned from leasing the premises, and interest that he could have earned if his capital was not invested in gold inventory, his business is actually running in deep losses.

Jeweller Vicky Bafna has a contradictory view – he is very keen on continuing with his family business. He believes that out of 250-300 jewellery shops in Virar, 45-50% are on rent and have also borrowed capital to invest in gold inventory. So far, 8-10 jewellery shops have closed down in the last year and in some cases, customers have lost money as unreliable jewellers have run away, taking their deposits with them. However, he believes he is actually benefitting from this trend. His customers from the lower-income group hesitate going to large-format jewellers and prefer player like him (we have been in this business since donkey’s years). “With my father retiring, I constantly engage with my customers on Whatsapp and regularly send message showcasing latest jewellery design/ trends.”

“Senior members of families continue to buy from family/traditional jewellers, but the younger generation is breaking the trend and is looking at buying from well-known brands only.”

-Pratik Jain of Kshitij Jewellers

Kajal Rawat, in her late twenties, is a sales executive working with a reputed MNC. She revealed that she prefers branded players because: (1) they have more choices in design, especially in studded jewellery, (2) they are more reliable (I feel safe to buy from them because I know they are genuine in terms of purity, and (3) they have better quality (The finishing of the set is better). “Their designs are simple and elegant, which traditional jewellers are not able to provide,” she said.

Mansi Shah, 27, a prospective bride who stays in Grant Road, Mumbai, couldn’t stop cracking up when she let slip that she “ditched” her family jeweller and is looking at buying jewellery from Tanishq or TBZ for her wedding. “Variety and design and latest trends are a priority over making charges. After the Nirav Modi fiasco, it has become difficult to trust small jewellers,” she chuckles.

Limited space/designs restricts unorganised players’ ‘right to win’

Right to win is a concept that is popularly used in the FMCG industry. It signifies the ability to engage in any competitive market with a better chance of success — not just in the short term, but consistently. It is also applicable in the jewellery industry to a certain extent.

Joint families manage most small jewellery shops and each member may not be highly motivated, since the benefits are shared by all members (even when efforts are put in by only one or two people). With such limitations, smaller jewellers may not have the “Right to Win” beyond their target markets.

Subscribe to enjoy uninterrupted access